Resolution Minerals jumps straight into antimony exploration at Drake East

- Resolution Minerals starts LiDAR survey at its Drake East antimony-gold project to generate targets

- Project hosts antimony occurrences in an area that is part of broader zone shared with the neighbouring third-party Drake project

- Drake East is one of three projects the company is acquiring to position itself as a critical minerals explorer and developer

Special Report: Resolution Minerals (ASX:RML) has wasted no time launching a LiDAR survey to better understand its recently acquired Drake East project in NSW that is believed to host high-grade antimony, gold and silver mineralisation.

It comes amidst record high antimony and gold prices.

The former is pulling as much as US$50,000/t – roughly quadruple its cost in early 2024 – due to China’s ban on exporting the metal used in the production of ammunition and solar panels, while the safe haven commodity gold broke past the US$3000/oz mark for the first time on Friday.

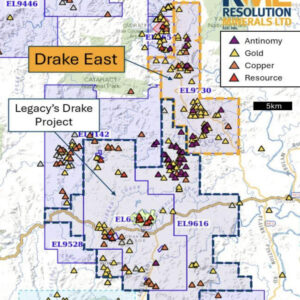

The project – one of three in NSW and Queensland that Resolution Minerals (ASX:RML) signed a binding agreement to acquire on March 10, 2025 – is adjacent to the Drake gold-copper project where Legacy Minerals (ASX:LGM) is developing a large epithermal gold-copper mineralised system.

Importantly, Drake hosts dozens of antimony occurrences which are concentrated close to its western boundary with the company’s Drake East project, while recent rock chips from the Lunatic prospect just 2.2km from Drake East returned assays of up to 30% antimony.

Don’t go thinking it’s just nearology.

Drake East contains antimony occurrences over a large area with a strike length of over 15km considered part of the same broader trans-project-scale antimony mineralised zone that occurs on Drake.

Sampling has returned peak assays of up to 5.72% antimony, 60.9g/t gold and 214g/t silver.Being able to verify Drake East’s potential to host significant antimony and gold will go a long way towards realising value for Resolution, given that LGM has a market capitalisation about six times greater.

This will in turn cement RML’s new position as a critical minerals explorer and developer at a time when China and the US under President Donald Trump engage in a trade war with China leveraging its critical minerals bounty and/or processing capacity.

Drake East is close to the Drake project. Pic: Resolution Minerals

Drake East exploration

The LiDAR survey that is being acquired and interpreted is aimed at generating targets for further investigation and possible drilling.

This will identify historical workings and geomorphological features relating to antimony and gold mineralisation.

It is expected to enhance Drake East’s antimony prospectivity by revealing the extent of antimony workings.

A similar interpretation completed by the same contractor for LGM – GeoCloud Australia –resulted in a 100% increase in the known historical mines and workings at the Drake project.

“The LiDAR interpretation will provide RML a truer indication of the extent of antimony mineralisation occurring at Drake East,” executive director Aharon Zaetz said.

“As the market has seen with Legacy, in their case, a 100% increase in the number of known mine workings, this program for RML will not only confirm existing targets but will generate possible new targets.

“It would be our objective to map and sample these targets in the near-term.”

RML plans to carry out systematic exploration programs, including geophysical surveys, geochemical sampling, and drilling campaigns, to evaluate the project’s mineral potential.

Critical minerals portfolio

Drake East is considered a highly prospective brownfields opportunity with past historical antimony production.

It hosts 14 known antimony occurrences, including the well-documented Mosquito Creek antimony-gold reef, along with over 50 gold occurrences including a placer gold resource at Lanikai west.

This placer gold occurrence is thought to extend about 750m along a small creek and includes historical workings with an extent of about 250m by 150m. Hand auger samples have returned an estimate of 1g/t native gold.

While it is undoubtedly exciting, the other projects acquired by the company are also intriguing.

The Neardie project about 20km north-northeast of Gympie, Queensland, includes three past producing antimony mines and hosts very high-grade antimony mineralisation with underground rock chip sampling returning peak grades of up to 19.5%.

RML believes that significant extensions of high grade antimony are possible, not only along strike and at depth but in parallel systems, as was concluded by a study in 1974.

Meanwhile, the Spur South gold-copper project sits in the prolific Macquarie Arc metal belt in NSW that hosts 25 known gold-copper porphyry systems, including six world-class gold-copper mines, 17 significant porphyry deposits and two mines in the feasibility study stage.

Spur South itself is surrounded by major deposits and prospective exploration projects such as Newcrest’s +50Moz gold, 9.5Mt copper Cadia Valley operations about 15km to the north-northeast and Waratah Minerals’ Spur project.

Zaetz noted the acquisition, which is being paid for largely through the issue of shares, offered a “unique opportunity” to broaden the company’s multi-commodity exploration activities in two of Australia’s most promising and proven regions for antimony, gold, silver and copper.

“The Neardie, Spur South and Drake East projects present exciting prospects that align with our strategy to unlock value from underexplored, high-potential assets,” he added.

“Global demand for antimony is rising quickly, and combined with supply shortage concerns, this has resulted in record-high prices of over US$50,000 per tonne for the commodity.

“With these projects in hand, RML is now poised to create substantial value for our shareholders and advance these projects toward their full potential.”

This article was developed in collaboration with Resolution Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Explore More

-

Investor Guide: Gold & Copper FY2025 featuring Barry FitzGerald

Investor Guide: Gold & Copper FY2025 featuring Barry FitzGerald

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10