Hewlett Packard Enterprise Company (NYSE:HPE) Looks Interesting, And It's About To Pay A Dividend

Hewlett Packard Enterprise Company (NYSE:HPE) stock is about to trade ex-dividend in four days. Typically, the ex-dividend date is one business day before the record date, which is the date on which a company determines the shareholders eligible to receive a dividend. The ex-dividend date is of consequence because whenever a stock is bought or sold, the trade takes at least one business day to settle. Therefore, if you purchase Hewlett Packard Enterprise's shares on or after the 21st of March, you won't be eligible to receive the dividend, when it is paid on the 18th of April.

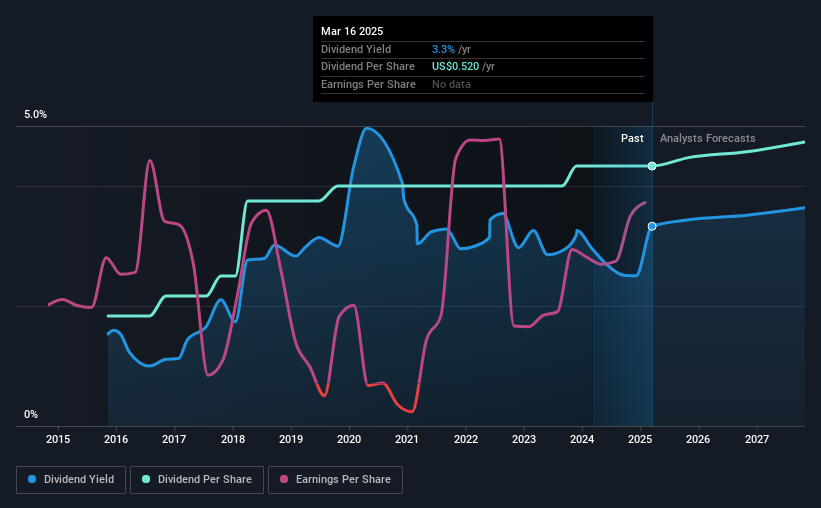

The company's next dividend payment will be US$0.13 per share, and in the last 12 months, the company paid a total of US$0.52 per share. Based on the last year's worth of payments, Hewlett Packard Enterprise has a trailing yield of 3.3% on the current stock price of US$15.62. If you buy this business for its dividend, you should have an idea of whether Hewlett Packard Enterprise's dividend is reliable and sustainable. We need to see whether the dividend is covered by earnings and if it's growing.

See our latest analysis for Hewlett Packard Enterprise

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. Hewlett Packard Enterprise has a low and conservative payout ratio of just 25% of its income after tax. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. Fortunately, it paid out only 43% of its free cash flow in the past year.

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies with consistently growing earnings per share generally make the best dividend stocks, as they usually find it easier to grow dividends per share. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. That's why it's comforting to see Hewlett Packard Enterprise's earnings have been skyrocketing, up 22% per annum for the past five years. Earnings per share have been growing very quickly, and the company is paying out a relatively low percentage of its profit and cash flow. Companies with growing earnings and low payout ratios are often the best long-term dividend stocks, as the company can both grow its earnings and increase the percentage of earnings that it pays out, essentially multiplying the dividend.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Hewlett Packard Enterprise has delivered an average of 10% per year annual increase in its dividend, based on the past nine years of dividend payments. It's exciting to see that both earnings and dividends per share have grown rapidly over the past few years.

Final Takeaway

Has Hewlett Packard Enterprise got what it takes to maintain its dividend payments? Hewlett Packard Enterprise has been growing earnings at a rapid rate, and has a conservatively low payout ratio, implying that it is reinvesting heavily in its business; a sterling combination. There's a lot to like about Hewlett Packard Enterprise, and we would prioritise taking a closer look at it.

With that in mind, a critical part of thorough stock research is being aware of any risks that stock currently faces. In terms of investment risks, we've identified 1 warning sign with Hewlett Packard Enterprise and understanding them should be part of your investment process.

A common investing mistake is buying the first interesting stock you see. Here you can find a full list of high-yield dividend stocks.

If you're looking to trade Hewlett Packard Enterprise, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hewlett Packard Enterprise might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10