Exploring 3 High Growth Tech Stocks in the US Market

Over the last 7 days, the United States market has remained flat, yet over the past 12 months, it has experienced a notable rise of 9.0%, with earnings projected to grow by 14% per annum in the coming years. In this context of steady market performance and optimistic growth forecasts, identifying high-growth tech stocks involves looking for companies that demonstrate strong potential for innovation and scalability in their operations.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| TG Therapeutics | 26.18% | 37.61% | ★★★★★★ |

| Palantir Technologies | 20.06% | 28.38% | ★★★★★★ |

| Alkami Technology | 20.45% | 85.16% | ★★★★★★ |

| Travere Therapeutics | 28.43% | 65.01% | ★★★★★★ |

| AVITA Medical | 27.78% | 55.33% | ★★★★★★ |

| Clene | 61.16% | 59.11% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.82% | 58.64% | ★★★★★★ |

| Blueprint Medicines | 22.38% | 55.91% | ★★★★★★ |

| TKO Group Holdings | 22.54% | 25.17% | ★★★★★★ |

| Lumentum Holdings | 21.55% | 119.67% | ★★★★★★ |

Click here to see the full list of 238 stocks from our US High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Amphenol (NYSE:APH)

Simply Wall St Growth Rating: ★★★★☆☆

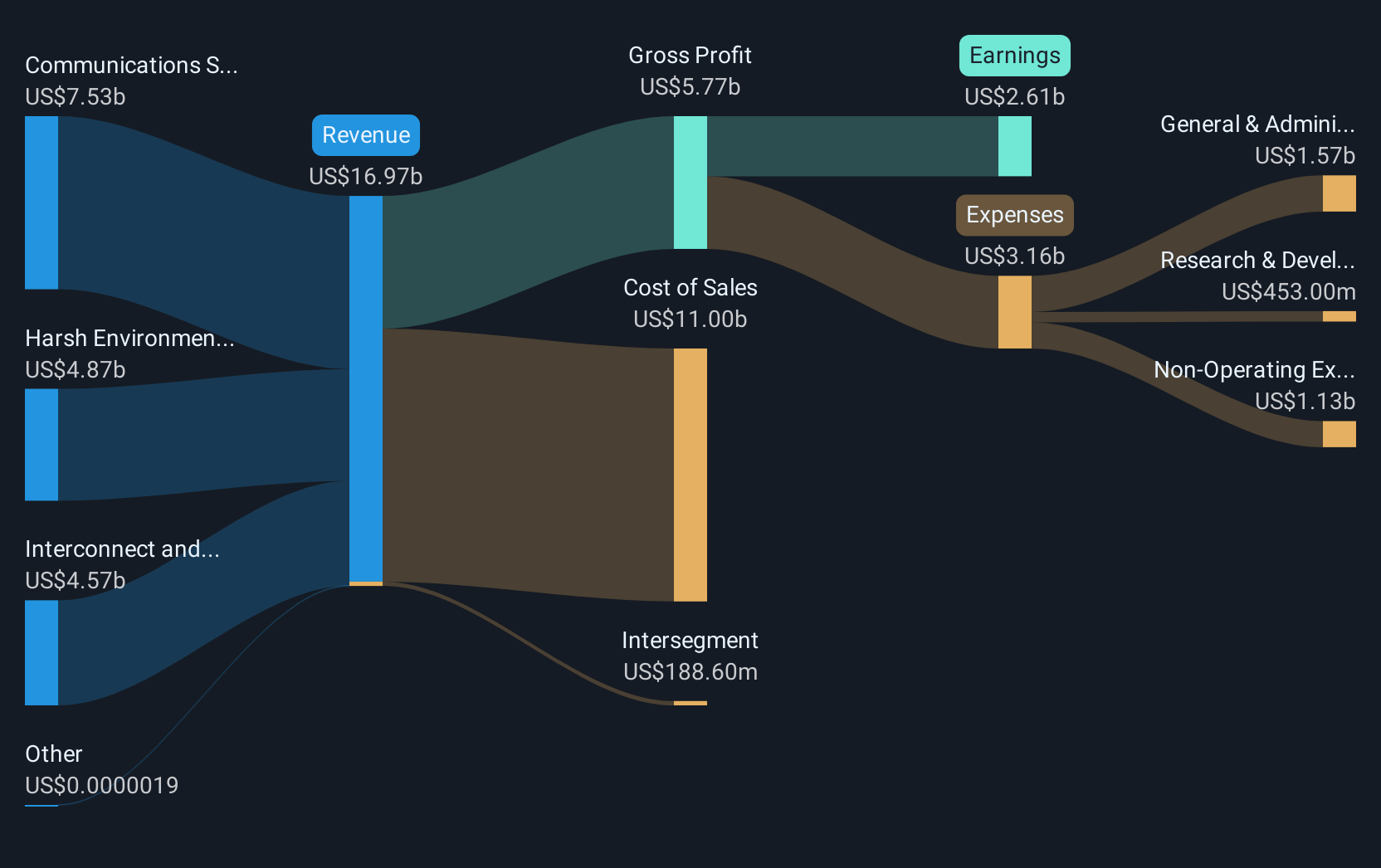

Overview: Amphenol Corporation is a global company that designs, manufactures, and markets electrical, electronic, and fiber optic connectors with a market capitalization of approximately $76.30 billion.

Operations: Amphenol generates revenue primarily through its three segments: Communications Solutions ($6.38 billion), Harsh Environment Solutions ($4.51 billion), and Interconnect and Sensor Systems ($4.51 billion). The company operates extensively in the United States, China, and other international markets.

Amphenol, amidst a competitive electronic components landscape, has demonstrated robust growth with a 25.7% increase in earnings over the past year, outpacing the industry's average. With revenue and earnings forecasted to grow annually at 11.1% and 14.7%, respectively, APH is advancing faster than the broader U.S. market projections of 8.5% and 13.9%. This growth trajectory is supported by strategic share repurchases totaling $514.4 million since last October and ongoing legal defenses to protect its technological innovations in connectivity solutions, highlighting both its aggressive market stance and commitment to safeguarding its intellectual property.

- Click here to discover the nuances of Amphenol with our detailed analytical health report.

Evaluate Amphenol's historical performance by accessing our past performance report.

Guidewire Software (NYSE:GWRE)

Simply Wall St Growth Rating: ★★★★☆☆

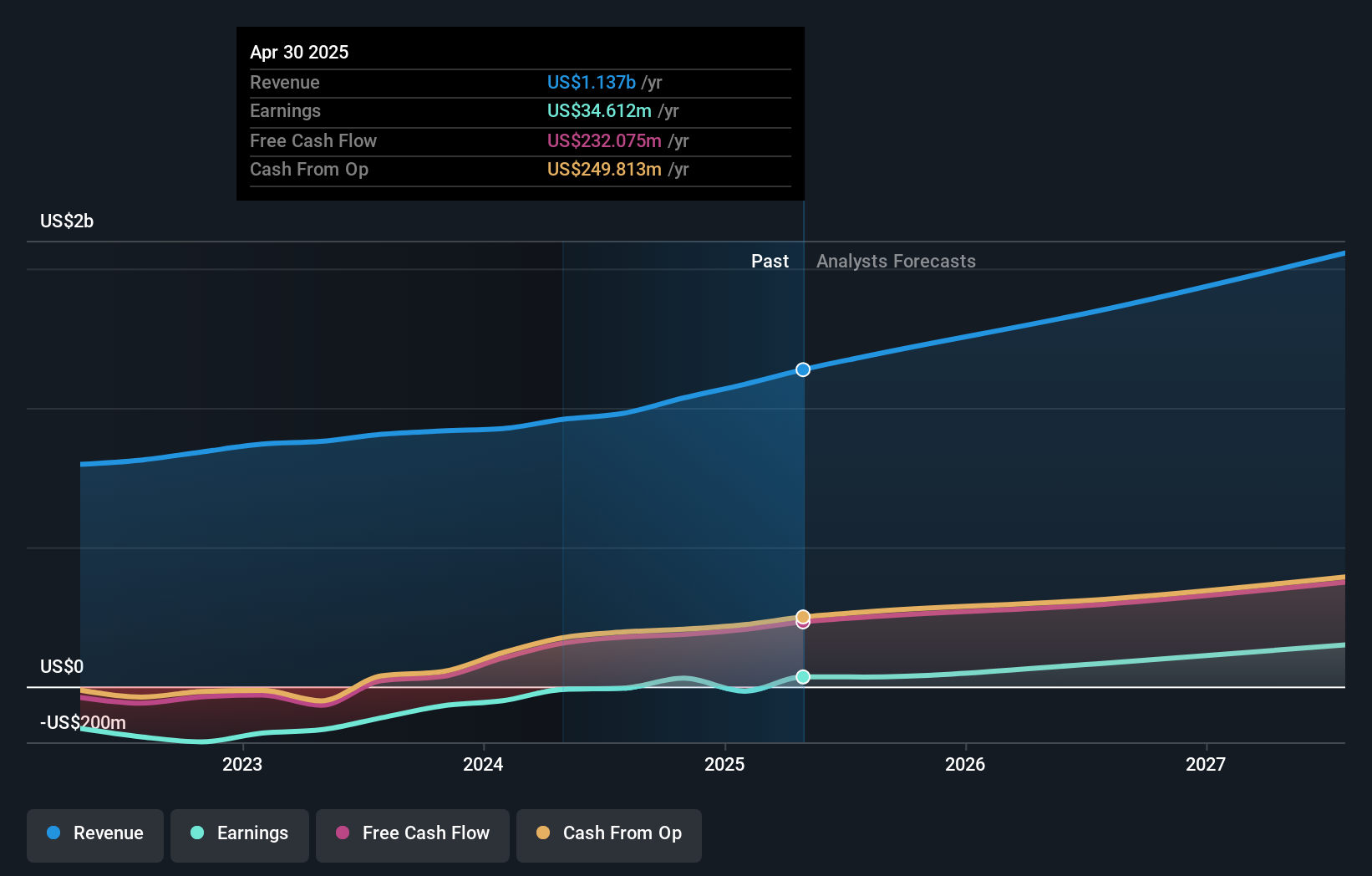

Overview: Guidewire Software, Inc. offers a platform designed for property and casualty insurers globally, with a market capitalization of $15.59 billion.

Operations: The company generates revenue primarily from its Software & Programming segment, which amounts to $1.08 billion.

Guidewire Software, transitioning to cloud-based solutions, has recently secured Montana State Fund as a client for its InsuranceSuite on Guidewire Cloud, emphasizing its strategic pivot towards more scalable and adaptable business models. This move is indicative of the broader industry trend where software firms are increasingly adopting SaaS models to ensure steady revenue streams through subscriptions. Despite a challenging fiscal period with a reported net loss of $37.28 million in Q2 2025 and an operating loss projected up to $4 million for Q3 2025, Guidewire's revenue trajectory remains positive with expected annual growth at 12.8%. The company's ongoing innovations and client acquisitions like Markel Group Inc., which also transitioned to Guidewire Cloud, underscore its potential resilience and adaptability in the evolving tech landscape.

- Take a closer look at Guidewire Software's potential here in our health report.

Explore historical data to track Guidewire Software's performance over time in our Past section.

Reddit (NYSE:RDDT)

Simply Wall St Growth Rating: ★★★★★☆

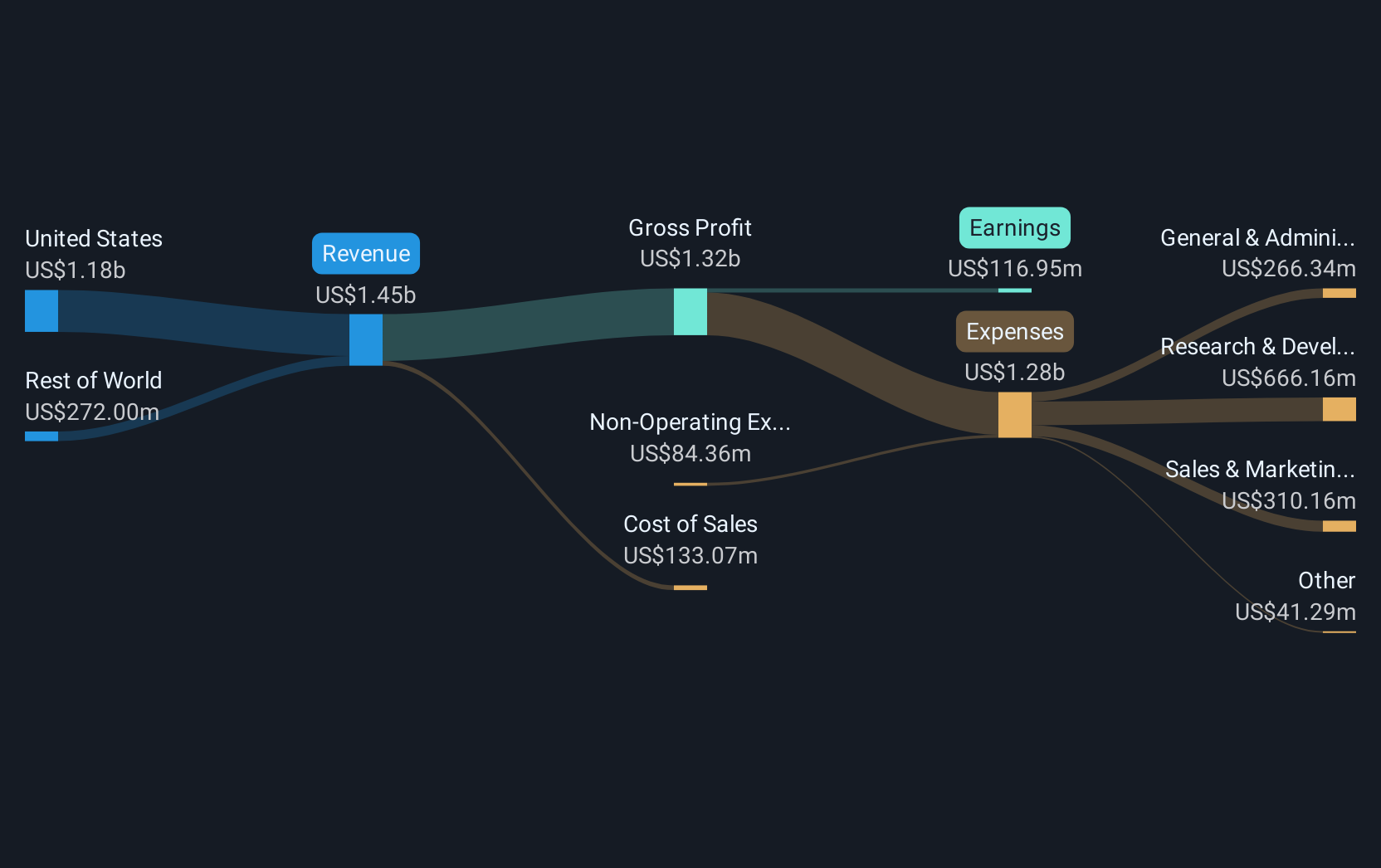

Overview: Reddit, Inc. operates a digital community platform both in the United States and internationally, with a market capitalization of $23.19 billion.

Operations: The company generates revenue primarily from its Internet Information Providers segment, totaling $1.30 billion.

Reddit, amid a challenging fiscal year with a net loss of $484.28 million, still showcased robust sales growth, escalating from $804.03 million to $1.3 billion annually—a 61.7% increase that underscores its expanding market presence. This growth trajectory is complemented by strategic acquisitions aimed at diversifying its advertiser base and enhancing ad relevance, reflecting an aggressive push to capitalize on digital advertising trends. Moreover, the company's collaboration with Intercontinental Exchange to leverage Reddit’s Data API for financial analytics products indicates innovative strides in utilizing big data for market insights, potentially setting new industry standards in data-driven decision-making and client services.

- Dive into the specifics of Reddit here with our thorough health report.

Gain insights into Reddit's historical performance by reviewing our past performance report.

Taking Advantage

- Investigate our full lineup of 238 US High Growth Tech and AI Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10