Does Illinois Tool Works (NYSE:ITW) Deserve A Spot On Your Watchlist?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Illinois Tool Works (NYSE:ITW). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for Illinois Tool Works

How Quickly Is Illinois Tool Works Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. We can see that in the last three years Illinois Tool Works grew its EPS by 12% per year. That's a good rate of growth, if it can be sustained.

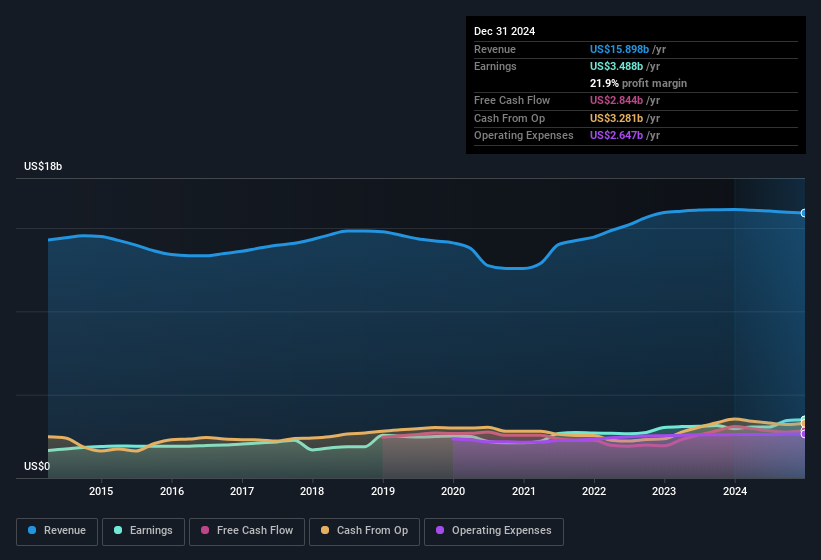

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. It was a year of stability for Illinois Tool Works as both revenue and EBIT margins remained have been flat over the past year. That's not bad, but it doesn't point to ongoing future growth, either.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Illinois Tool Works' future profits.

Are Illinois Tool Works Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

The first bit of good news is that no Illinois Tool Works insiders reported share sales in the last twelve months. But the important part is that Independent Director David H. Smith spent US$360k buying stock, at an average price of US$255. Big buys like that may signal an opportunity; actions speak louder than words.

On top of the insider buying, it's good to see that Illinois Tool Works insiders have a valuable investment in the business. Notably, they have an enviable stake in the company, worth US$242m. This comes in at 0.3% of shares in the company, which is a fair amount of a business of this size. So despite their percentage holding being low, company management still have plenty of reasons to deliver the best outcomes for investors.

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. That's because Illinois Tool Works' CEO, Chris O’Herlihy, is paid at a relatively modest level when compared to other CEOs for companies of this size. The median total compensation for CEOs of companies similar in size to Illinois Tool Works, with market caps over US$8.0b, is around US$13m.

The Illinois Tool Works CEO received US$6.9m in compensation for the year ending December 2023. That comes in below the average for similar sized companies and seems pretty reasonable. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does Illinois Tool Works Deserve A Spot On Your Watchlist?

As previously touched on, Illinois Tool Works is a growing business, which is encouraging. On top of that, we've seen insiders buying shares even though they already own plenty. That makes the company a prime candidate for your watchlist - and arguably a research priority. We don't want to rain on the parade too much, but we did also find 1 warning sign for Illinois Tool Works that you need to be mindful of.

Keen growth investors love to see insider activity. Thankfully, Illinois Tool Works isn't the only one. You can see a a curated list of companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10