3 Stocks That May Be Undervalued By Up To 49.5% According To Intrinsic Estimates

As the U.S. stock market faces turbulence with significant declines in major indices amidst tariff concerns and recession talks, investors are increasingly on the lookout for opportunities that may be undervalued. In this environment, identifying stocks trading below their intrinsic value can offer potential advantages, especially when broader market sentiment is low and economic uncertainties loom large.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Valley National Bancorp (NasdaqGS:VLY) | $8.67 | $17.24 | 49.7% |

| Semrush Holdings (NYSE:SEMR) | $9.70 | $19.07 | 49.1% |

| German American Bancorp (NasdaqGS:GABC) | $38.08 | $75.38 | 49.5% |

| International Paper (NYSE:IP) | $49.90 | $98.54 | 49.4% |

| KBR (NYSE:KBR) | $51.16 | $101.61 | 49.7% |

| Cadre Holdings (NYSE:CDRE) | $33.85 | $67.34 | 49.7% |

| Array Technologies (NasdaqGM:ARRY) | $6.38 | $12.63 | 49.5% |

| Albemarle (NYSE:ALB) | $76.39 | $150.99 | 49.4% |

| Workiva (NYSE:WK) | $85.11 | $168.68 | 49.5% |

| TransMedics Group (NasdaqGM:TMDX) | $66.03 | $130.15 | 49.3% |

Click here to see the full list of 192 stocks from our Undervalued US Stocks Based On Cash Flows screener.

Here we highlight a subset of our preferred stocks from the screener.

Array Technologies (NasdaqGM:ARRY)

Overview: Array Technologies, Inc. manufactures and sells solar tracking technology products in the United States, Spain, Brazil, Australia, and internationally with a market cap of approximately $934.88 million.

Operations: The company's revenue segments consist of $254.18 million from STI Operations and $661.63 million from Array Legacy Operations.

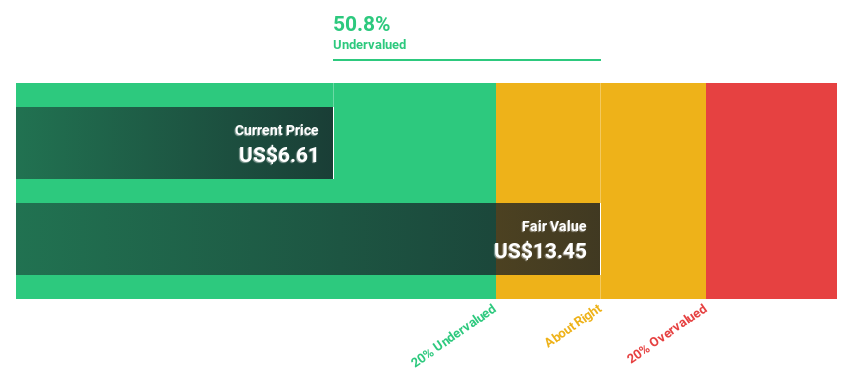

Estimated Discount To Fair Value: 49.5%

Array Technologies is trading at US$6.38, significantly below its estimated fair value of US$12.63, suggesting it may be undervalued based on cash flows. Despite recent financial challenges, including a net loss of US$240.39 million for 2024 and impairment charges totaling over US$165 million, the company is expected to become profitable within three years with high forecasted earnings growth and a projected return on equity reaching 60.8%.

- Our earnings growth report unveils the potential for significant increases in Array Technologies' future results.

- Get an in-depth perspective on Array Technologies' balance sheet by reading our health report here.

Futu Holdings (NasdaqGM:FUTU)

Overview: Futu Holdings Limited operates as a digitalized securities brokerage and wealth management product distributor in Hong Kong and internationally, with a market cap of approximately $15.59 billion.

Operations: The company generates revenue primarily from its online brokerage services and margin financing, totaling HK$10.16 billion.

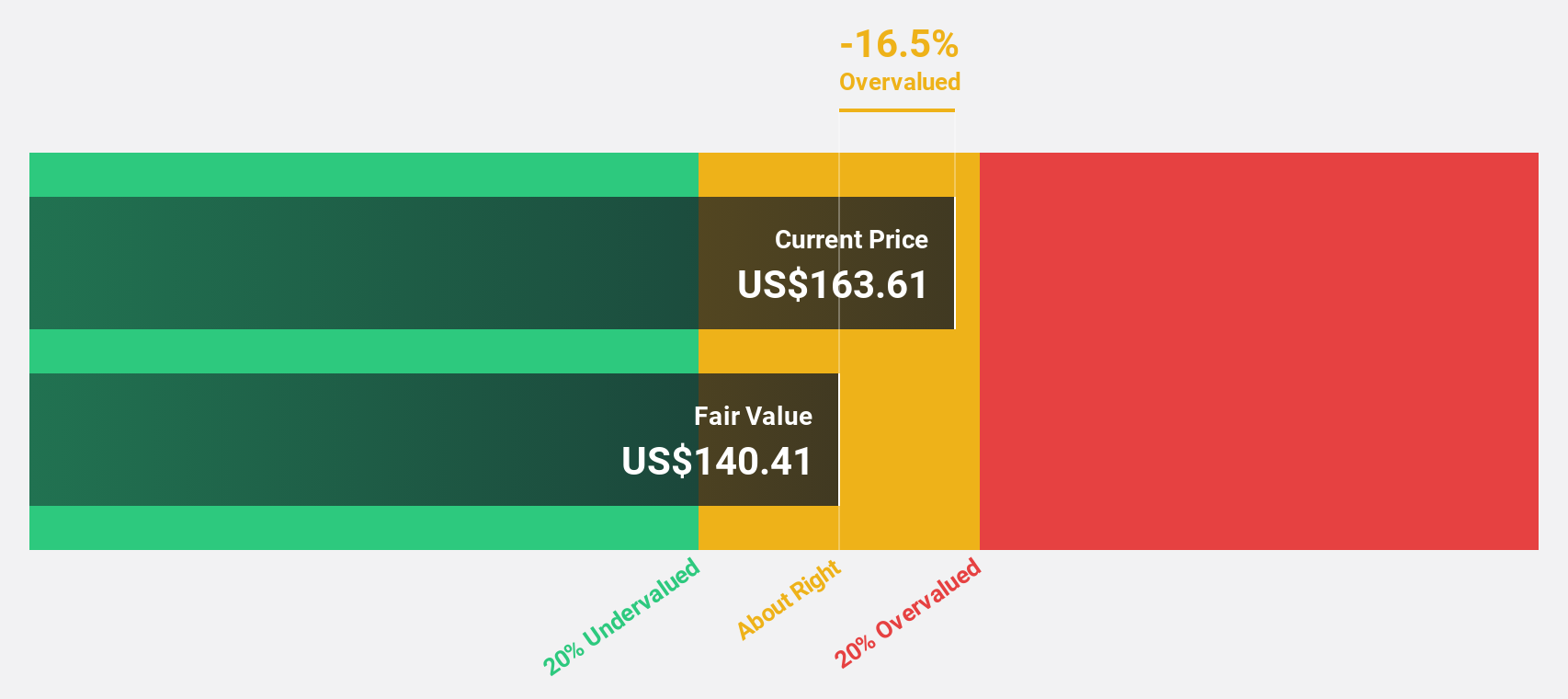

Estimated Discount To Fair Value: 12.9%

Futu Holdings is trading at US$106.06, slightly below its estimated fair value of US$121.7, reflecting potential undervaluation based on cash flows. The company is forecast to experience robust revenue growth of 20.4% annually, outpacing the broader US market's 8.4% growth rate, and earnings are expected to rise significantly by 25.3% per year over the next three years, supported by a high projected return on equity of 20.3%.

- Our expertly prepared growth report on Futu Holdings implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Futu Holdings stock in this financial health report.

Sea (NYSE:SE)

Overview: Sea Limited operates in digital entertainment, e-commerce, and digital financial services across Southeast Asia, Latin America, and other international markets with a market cap of approximately $77.93 billion.

Operations: The company's revenue is primarily derived from its e-commerce segment at $12.42 billion, followed by digital financial services at $2.37 billion, and digital entertainment contributing $1.91 billion.

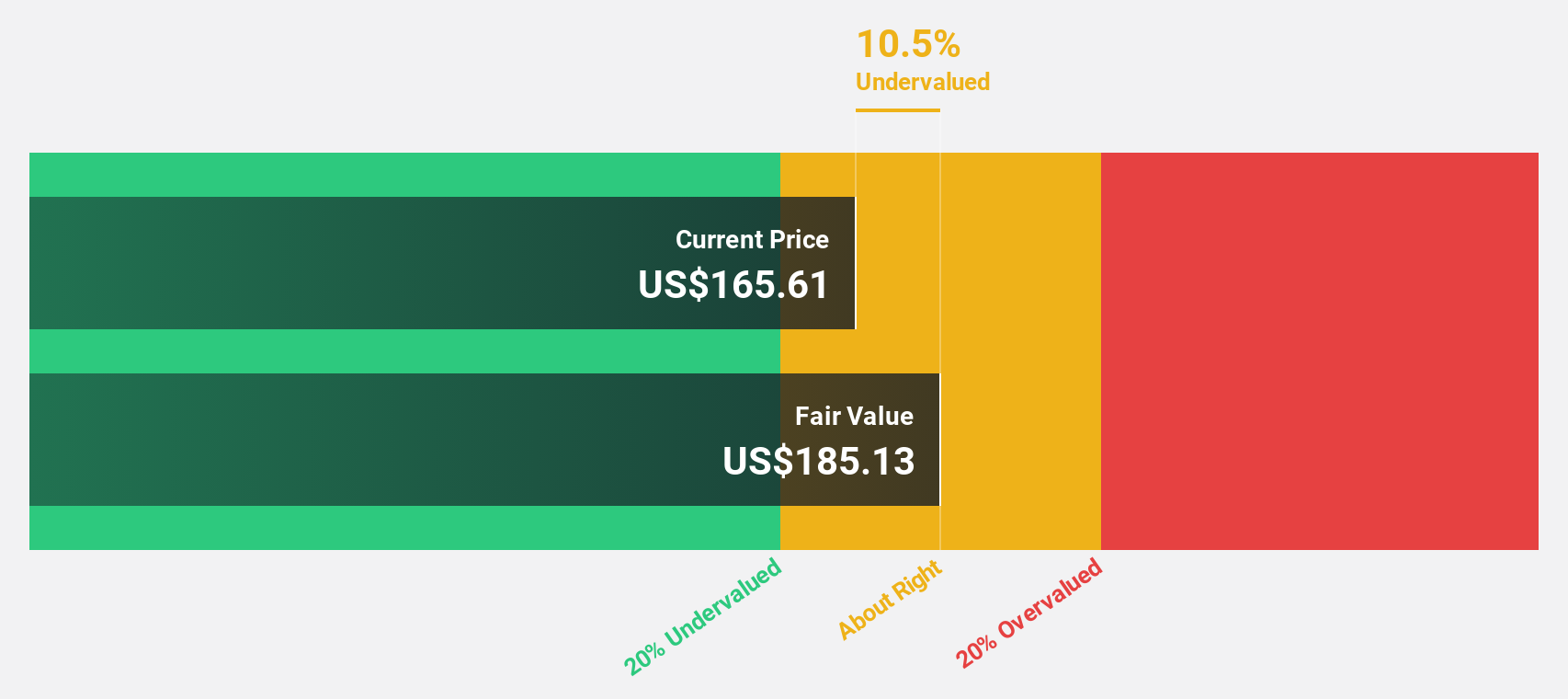

Estimated Discount To Fair Value: 32.7%

Sea is trading at US$127.32, significantly below its fair value estimate of US$189.08, indicating undervaluation based on cash flows. The company's revenue grew to US$16.82 billion from US$13.06 billion year-over-year, with net income rising to US$444.32 million from US$150.73 million, showcasing strong financial performance despite large one-off items affecting earnings quality. Analysts expect earnings to grow at 32.4% annually over the next three years, surpassing the broader market growth rate of 13.8%.

- In light of our recent growth report, it seems possible that Sea's financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of Sea.

Summing It All Up

- Click here to access our complete index of 192 Undervalued US Stocks Based On Cash Flows.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Array Technologies, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10