Here's Why We're Wary Of Buying PWR Holdings' (ASX:PWH) For Its Upcoming Dividend

PWR Holdings Limited (ASX:PWH) is about to trade ex-dividend in the next four days. Typically, the ex-dividend date is two business days before the record date, which is the date on which a company determines the shareholders eligible to receive a dividend. It is important to be aware of the ex-dividend date because any trade on the stock needs to have been settled on or before the record date. Thus, you can purchase PWR Holdings' shares before the 13th of March in order to receive the dividend, which the company will pay on the 21st of March.

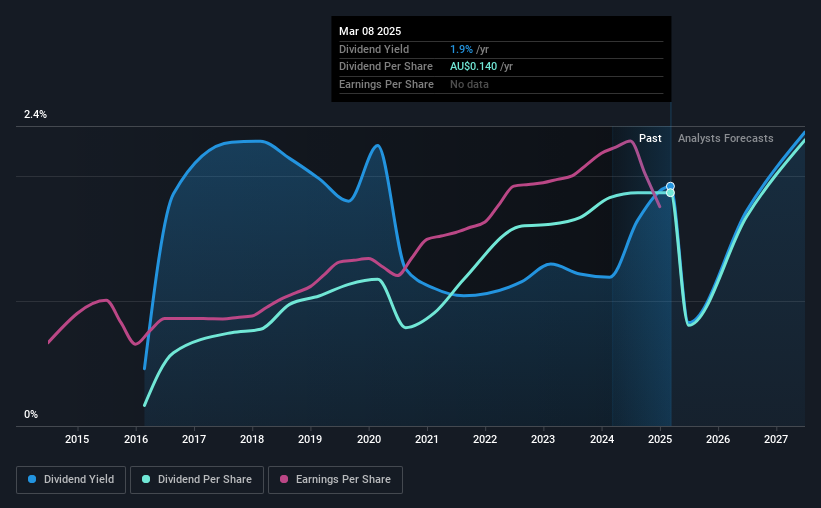

The company's next dividend payment will be AU$0.02 per share, on the back of last year when the company paid a total of AU$0.14 to shareholders. Calculating the last year's worth of payments shows that PWR Holdings has a trailing yield of 1.9% on the current share price of AU$7.30. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. We need to see whether the dividend is covered by earnings and if it's growing.

View our latest analysis for PWR Holdings

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. PWR Holdings is paying out an acceptable 59% of its profit, a common payout level among most companies. A useful secondary check can be to evaluate whether PWR Holdings generated enough free cash flow to afford its dividend. PWR Holdings paid out more free cash flow than it generated - 186%, to be precise - last year, which we think is concerningly high. We're curious about why the company paid out more cash than it generated last year, since this can be one of the early signs that a dividend may be unsustainable.

While PWR Holdings's dividends were covered by the company's reported profits, cash is somewhat more important, so it's not great to see that the company didn't generate enough cash to pay its dividend. Were this to happen repeatedly, this would be a risk to PWR Holdings's ability to maintain its dividend.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. This is why it's a relief to see PWR Holdings earnings per share are up 6.0% per annum over the last five years. Earnings have been growing at a steady rate, but we're concerned dividend payments consumed most of the company's cash flow over the past year.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. In the past nine years, PWR Holdings has increased its dividend at approximately 31% a year on average. It's encouraging to see the company lifting dividends while earnings are growing, suggesting at least some corporate interest in rewarding shareholders.

To Sum It Up

From a dividend perspective, should investors buy or avoid PWR Holdings? Earnings per share have grown somewhat, although PWR Holdings paid out over half its profits and the dividend was not well covered by free cash flow. It's not the most attractive proposition from a dividend perspective, and we'd probably give this one a miss for now.

Wondering what the future holds for PWR Holdings? See what the seven analysts we track are forecasting, with this visualisation of its historical and future estimated earnings and cash flow

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

If you're looking to trade PWR Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10