BioNTech Earnings Are Imminent; These Most Accurate Analysts Revise Forecasts Ahead Of Earnings Call

BioNTech SE (NASDAQ:BNTX) will release its fourth-quarter financial results before the opening bell on Monday, March 10.

Analysts expect the Mainz, Germany-based company to report quarterly earnings at 25 cents per share, down from $1.90 per share in the year-ago period. BioNTech projects quarterly revenue of $1.15 billion, compared to $1.48 billion a year earlier, according to data from Benzinga Pro.

On Tuesday, the U.S. Food and Drug Administration (FDA) placed a clinical hold on BioNTech's Investigational New Drug application (IND) and the related Phase 1/2a trial evaluating the safety, tolerability, immunogenicity, and efficacy of an investigational RNA-based vaccine (BNT165e) for prevention of P. falciparum malaria in healthy malaria-naive adults.

BioNTech shares fell 3.4% to close at $110.83 on Thursday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

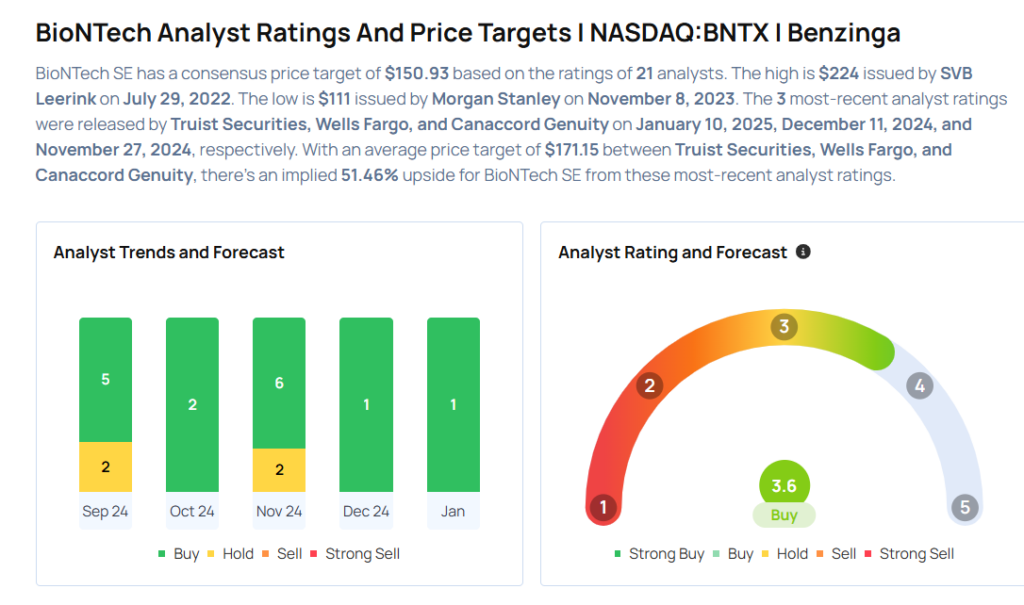

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- Wells Fargo analyst Mohit Bansal initiated coverage on the stock with an Overweight rating and a price target of $172 on Jan. 10, 2025. This analyst has an accuracy rate of 74%.

- Canaccord Genuity analyst William Maughan maintained a Buy rating and increased the price target from $171 to $171.44 on Nov. 27, 2024. This analyst has an accuracy rate of 71%.

- JP Morgan analyst Jessica Fye maintained a Neutral rating and cut the price target from $124 to $122 on Nov. 26, 2024. This analyst has an accuracy rate of 66%.

- Evercore ISI Group analyst Cory Kasimov upgraded the stock from In-Line to Outperform and raised the price target from $110 to $125 on Nov. 19, 2024. This analyst has an accuracy rate of 70%.

- Morgan Stanley analyst Terence Flynn upgraded the stock from Equal-Weight to Overweight and increased the price target from $93 to $145 on Sept. 24, 2024. This analyst has an accuracy rate of 68%.

Considering buying BNTX stock? Here’s what analysts think:

Read This Next:

- Wall Street’s Most Accurate Analysts Give Their Take On 3 Defensive Stocks Delivering High-Dividend Yields

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10