Arista Networks (NYSE:ANET) Stock Drops 10% Despite Strong 2024 Financial Performance

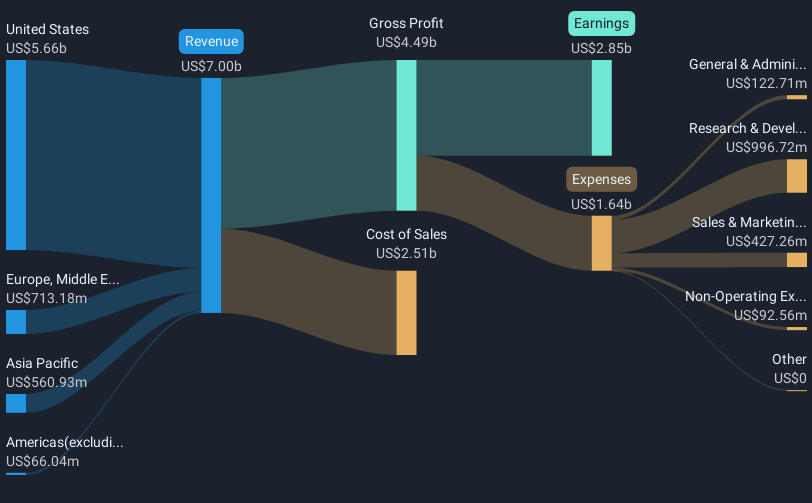

Arista Networks (NYSE:ANET) announced strong financial performance for 2024, showing substantial increases in revenue and net income. Despite this positive financial news, the company's stock experienced a 10% decline in the last quarter. This price movement might reflect investor concerns tied to broader market conditions, where major indexes like the Nasdaq and S&P 500 saw declines due to global economic factors, including potential tariff impacts and a general downturn in the tech sector. Moreover, despite a significant share buyback, amounting to approximately 0.14% of total shares repurchased, Arista's stocks were not insulated from the tech industry's broader volatility. The Nasdaq, a tech-heavy index, was down 5.5% in February, marking its worst month since September 2023. These external pressures likely offset any positive momentum from Arista's earnings growth and corporate actions, influencing its quarterly stock performance amidst a challenging market backdrop.

Unlock comprehensive insights into our analysis of Arista Networks stock here.

The past five years have witnessed Arista Networks achieving a very large total return of 645.38%, propelled by several key developments. Earnings growth averaged 31.7% annually, reflecting robust profitability enhancement. The company's net profit margins improved significantly, highlighting effective cost management and enhanced operational efficiency. Their merger with Awake Security in March 2020 expanded cybersecurity capabilities, aligning well with the increasing market demand for security solutions. In August 2022, a strategic partnership with Forescout Technologies bolstered network security, providing solutions against IoT threats, further cementing Arista's competitive position.

Alongside operational achievements, Arista's product innovation played a crucial role. In June 2024, new Etherlink AI platforms were launched, catering to the growing AI market. Additionally, the 4-for-1 stock split approved in November 2024 aimed to improve stock accessibility, potentially attracting a broader investor base. These elements collectively drove Arista's substantial longer-term returns while differentiating its performance against industry peers, with a 36.6% earnings growth in the past year significantly outpacing the communications sector.

- Unlock the insights behind Arista Networks' valuation and discover its true investment potential

- Analyze the downside risks for Arista Networks and understand their potential impact—click to learn more.

- Got skin in the game with Arista Networks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10