Walmart (NYSE:WMT) Expands Personal Care Line with Harry Slatkin's Affordable Dwell212 Under US$10

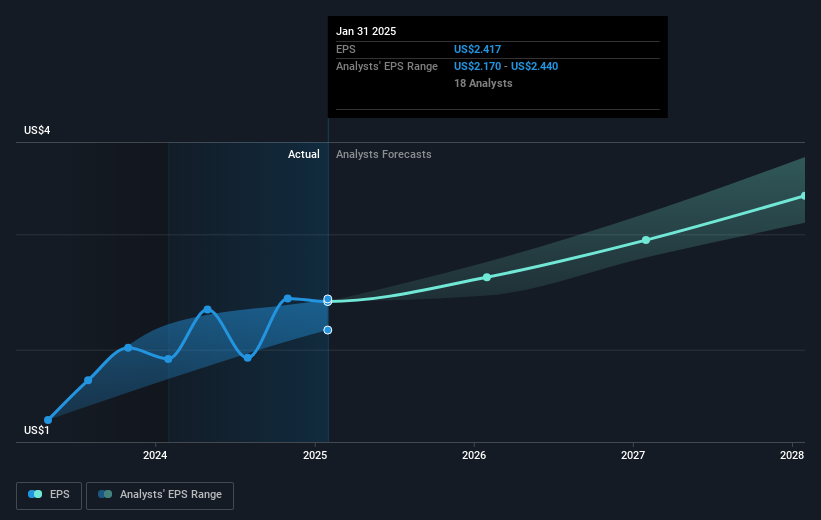

In a vibrant quarter for Walmart (NYSE:WMT), the company's stock rose by 6%, driven by a series of strategic developments. A highlight was the launch of the Dwell212 wellness-inspired body care line, contributing to its portfolio of mood-enhancing products. Additionally, Walmart's collaboration with Cal Water to simplify bill payments and the introduction of RADCam on its platform enhanced its customer-centric offerings. Financial moves, like a 13% dividend increase and aggressive share buybacks amounting to $1.4 billion, underscored its robust financial strategy. Despite fluctuating market dynamics, such as the Dow's recovery after a slump and growing inflation concerns, Walmart managed to navigate the landscape effectively, supported by strong earnings of $19.4 billion and a positive outlook predicting a 3% to 4% sales increase. As the broader market experienced a 3.9% decline, Walmart's targeted initiatives helped sustain its upward momentum, aligning it with the market's overarching annual upward trend of 17%.

Unlock comprehensive insights into our analysis of Walmart stock here.

Over a five-year span, Walmart's total shareholder return reached an impressive 179.76%, reflecting a strong performance during this period. This robust growth was fueled by several key developments. In 2020, the launch of Walmart+ helped the company contend with competitors like Amazon. The same year, new initiatives such as the introduction of Walmart Health centers expanded their service offerings, providing diversified revenue streams. Additionally, Walmart's partnership with thredUP marked a significant entry into the fashion resale market.

Recent years saw Walmart committing resources toward improving operational efficiency and customer experience, evident in their expansion efforts including the unveiling of a new 350-acre Home Office Campus in Arkansas. Financially, the company's performance was bolstered by considerable earnings growth, significantly surpassing industry averages over the past year. Furthermore, aggressive share buybacks, such as the repurchase of 15.9 million shares, underscored Walmart's shareholder-focused approach, aligning well with its high total return amid broader market challenges.

- See how Walmart measures up with our analysis of its intrinsic value versus market price.

- Assess the downside scenarios for Walmart with our risk evaluation.

- Are you invested in Walmart already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Walmart might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10