Opinion: This Is Cathie Wood's Best Stock For Under $20

-

Cathie Wood's portfolio at Ark Invest holds a number of speculative stocks.

-

One company in Ark's portfolio showing signs of maturity is fintech stock SoFi Technologies.

-

Despite its impressive operating results, SoFi stock trades at a considerable discount to its peers.

One of the hallmarks of Ark Investment Management CEO Cathie Wood's investment style is her ability to identify emerging opportunities that seek to disrupt legacy incumbents -- specifically, in industries such as technology.

With that said, many of the companies in Wood's portfolio could still be classified as speculative. For example, Wood has taken a liking to smaller biotech and AI stocks, many of which reflect low share prices and market capitalizations compared to their larger competitors.

However, one company in the Ark portfolio that looks promising and is demonstrating its ability to compete with bigger players is fintech stock SoFi Technologies (SOFI -2.11%).

Let's assess SoFi's recent business success and explore why the company's valuation appears reasonable right now.

SoFi's business is operating from a position of strength

2024 was a milestone year for SoFi. While the company grew its net revenue 26% year over year, it's where that growth came from that deserves a closer look.

SoFi reports its revenue into three categories: lending, financial services, and technology applications. The main contributors to SoFi's revenue and profit base stem from the lending operation and financial services business. While both of these businesses rely on net interest income, the lending segment focuses on student, personal, and home loans while the financial services segment is geared toward other banking products such as checking and savings accounts, brokerage services, and credit cards.

The company's lending segment, which accounted for 55% of total net revenue, only grew by 8% in 2024. Remember, the state of the macroeconomy was still cloudy for much of last year, with the Federal Reserve only beginning to taper interest rates in September. As a result, SoFi's lending segment had been performing rather sluggishly for the last couple of years. It only began to see a rebound in the latter quarters of 2024.

Thankfully, SoFi has a diversified product offering. Last year, the company's investments in other areas of financial services really stole the show. The company's financial services division grew net revenue by 88% year over year, to $821 million. Even better? This segment transitioned from a cash-burning business to one operating at 37% contribution margin.

SoFi's widening contribution profits have contributed to the company's transition from a cash-burning business to a consistently profitable enterprise. However, looking at the company's net income alone can be a little misleading. During 2024, SoFi reported total GAAP net income of $499 million; however, this included approximately $272 million of non-recurring tax benefits. For this reason, the company's GAAP earnings per share (EPS) may appear a little inflated when making year over year comparisons.

The important concept to understand here is that SoFi is accelerating both sales and profits from its non-core lending businesses. By broadening its revenue base while also commanding improved unit economics, SoFi is swiftly emerging as a legitimate player in a fiercely competitive financial services landscape.

Image source: Getty Images.

Analyzing SoFi's valuation

Valuing SoFi can be a tricky exercise. While the company is profitable on a generally accepted accounting principles (GAAP) basis, the company's earnings are still quite small. For this reason, using earnings-based valuation multiples when looking at SoFi aren't necessarily a good measure.

SoFi competes heavily with other leading fintechs such as Robinhood. These companies generate much of their sales and profits from transaction fees from trading and net interest spreads. For this reason, I'm benchmarking SoFi against Robinhood using both the price-to-book (P/B) ratio and price-to-sales (P/S) multiple.

Despite some noticeable valuation expansion over the last year, SoFi's P/B and P/S multiples trail Robinhood by a considerable margin.

SOFI Price to Book Value data by YCharts

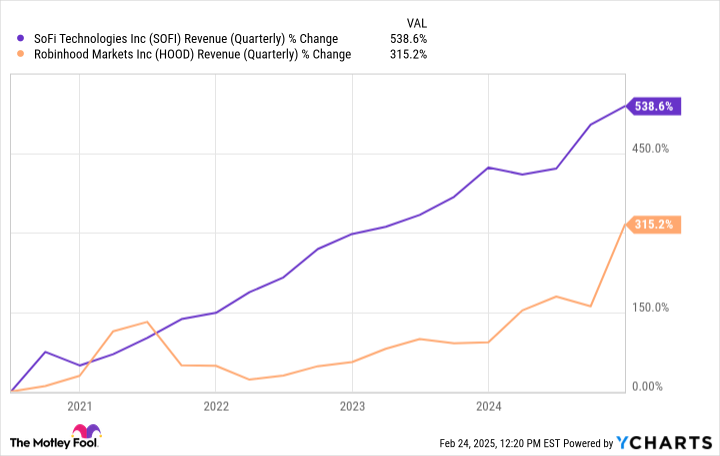

Considering SoFi has demonstrated superior growth compared to Robinhood over the last several years, the gap between each company's valuation could suggest that SoFi is trading for a discount.

SOFI Revenue (Quarterly) data by YCharts

Should you buy SoFi stock for just $15?

Cathie Wood owns a lot of stocks that trade for share prices below $20. In my opinion, many of the smaller stocks in Wood's portfolio are in businesses that could be compared to late-stage start-ups, given their recurring high levels of cash burn and unpredictable growth trajectories. Yet, many of these same companies have attained valuations in the billions -- which I tend to find a bit silly. To me, these valuations are disconnected from the underlying fundamentals among these businesses. I can't say the same about SoFi, though.

SoFi is growing both sales and profits across its major reporting segments. Furthermore, the company is trading at a considerable discount relative to perhaps its main peer in the fintech realm, suggesting that some investors may not be fully appreciating the long-term potential of SoFi.

To me, SoFi is a more mature company within the Ark portfolio -- and one that deserves some more attention. I think now is a great opportunity for long-term investors to scoop up shares of SoFi at a reasonable price point.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10