BigBear.ai Holdings (NYSE:BBAI) Soars 165% With Kevin McAleenan Named New CEO

BigBear.ai Holdings (NYSE:BBAI) experienced a remarkable 165% share price increase over the last quarter, strongly influenced by key events. The company's participation in Exercise Talisman Sabre 2025 and a collaboration with SoftPoint illustrate its expanding role in defense and security sectors. Securing contracts with the Department of Defense and the U.S. Navy further bolstered its credibility. The transition of Kevin McAleenan as CEO underscores strategic leadership adjustments aiming to capitalize on these opportunities. During this period, broader market indices showed mixed performance; the Dow inched up while Nasdaq declined. Despite a 3.6% market pullback over the week, BigBear.ai's robust position in defense and tech sectors served as a counterbalance. Other global developments, such as tariff announcements by President Trump, may affect economic sentiment but do not directly impact BigBear.ai's AI and defense-centric operations, which strategically align with anticipated market growth trends.

Click here and access our complete analysis report to understand the dynamics of BigBear.ai Holdings.

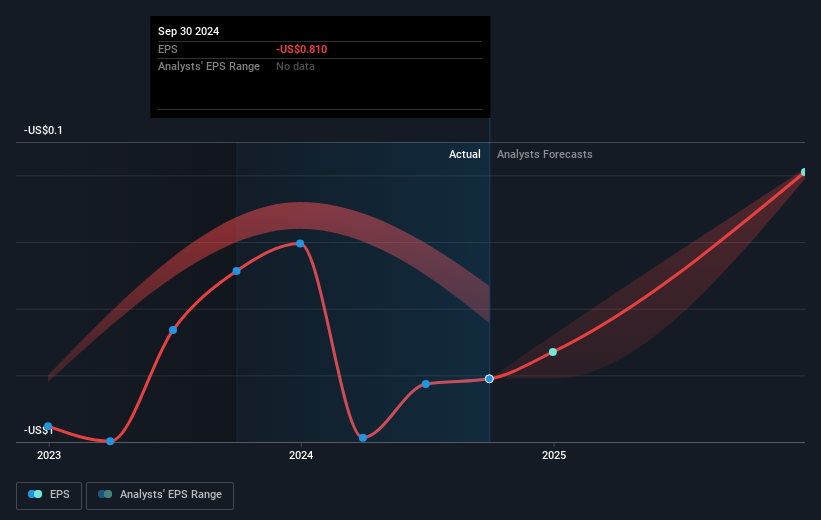

Over the past year, BigBear.ai Holdings achieved a total shareholder return of 81.21%, outpacing both the broader US market, which returned 16.7%, and the US IT industry return of 12.2%. Key drivers for this performance include major developments and contracts. The company's inclusion in multiple Russell indices, such as the Russell 2000 Value Index in July 2024, likely enhanced investor visibility and demand. Similarly, significant contracts, such as the five-year $165.15 million deal with the U.S. Army awarded in October 2024, underlined BigBear.ai's growing influence in defense technology.

In the financial realm, the strategic conversion of $182.3 million in convertible notes into new senior secured notes in December 2024 potentially improved the company's financial flexibility. Additionally, securing a position on the GSA's OASIS+ contract in December 2024 allowed BigBear.ai to further solidify its presence in federal contracting domains, affirming its trajectory for sustained revenue growth above the overall US market average.

- Understand the fair market value of BigBear.ai Holdings with insights from our valuation analysis—click here to learn more.

- Analyze the downside risks for BigBear.ai Holdings and understand their potential impact—click to learn more.

- Is BigBear.ai Holdings part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BigBear.ai Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10