These Analysts Raise Their Forecasts On GoDaddy After Q4 Results

GoDaddy Inc. (NYSE:GDDY) reported weaker-than-expected earnings for its fourth quarter on Thursday.

The company posted quarterly earnings of $1.36 per share which missed the analyst consensus estimate of $1.43 per share. The company reported quarterly sales of $1.192 billion which beat the analyst consensus estimate of $1.179 billion.

“GoDaddy demonstrated strong operational execution and financial performance in 2024, making significant progress across our key strategic initiatives,” said GoDaddy CEO Aman Bhutani. “Looking ahead to 2025, we are excited to further innovate around GoDaddy Airo, enhance our integrated technology platform and create even more value for our customers.”

GoDaddy said it sees first-quarter revenue of $1.175 billion to $1.195 billion versus estimates of $1.186 billion.

GoDaddy shares gained 2.4% to close at $212.54 on Thursday.

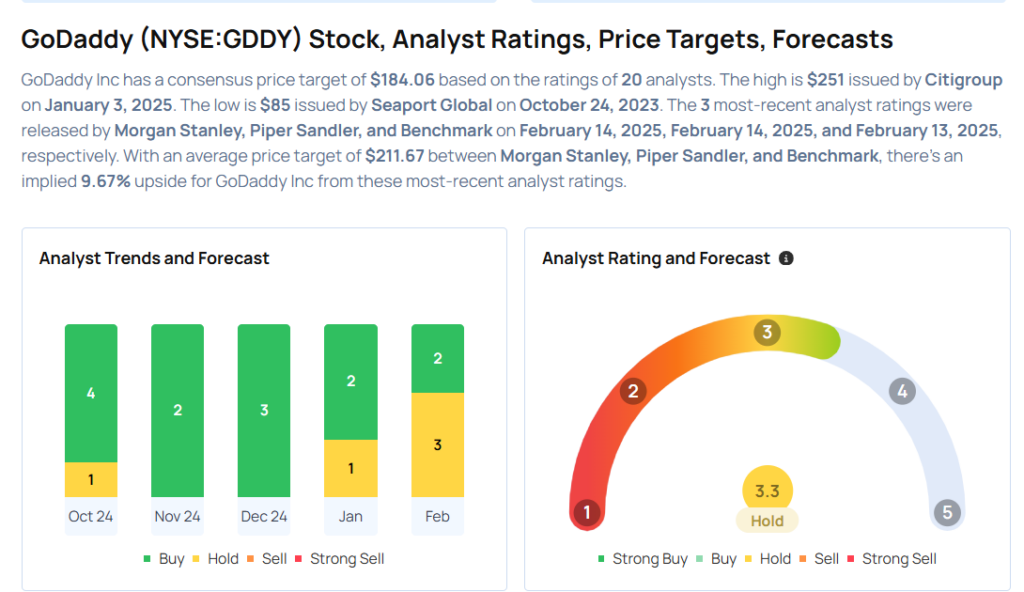

These analysts made changes to their price targets on GoDaddy following earnings announcement.

- Piper Sandler analyst Clarke Jeffries maintained GoDaddy with a Neutral and raised the price target from $176 to $177.

- Morgan Stanley analyst Elizabeth Elliott maintained GoDaddy with an Equal-Weight and raised the price target from $227 to $228.

Considering buying GDDY stock? Here’s what analysts think:

Read This Next:

- Top 3 Consumer Stocks You May Want To Dump In February

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10