These Analysts Boost Their Forecasts On Arm Holdings After Upbeat Q3 Results

Arm Holdings Plc (NASDAQ:ARM) reported better-than-expected third-quarter financial results for fiscal year 2025 after the market close on Wednesday.

Arm reported third-quarter revenue of $983 million, beating analyst estimates of $946.73 million. The chip designer reported adjusted earnings of 39 cents per share, beating analyst estimates of 34 cents per share, according to Benzinga Pro.

"Arm delivered record third-quarter revenue driven by continued strong adoption of Armv9 and CSS compute platforms," said Rene Haas, CEO of Arm Holdings. "With our high-performance, energy-efficient, flexible technology, Arm is a key enabler in advancing AI innovation and transforming the user experience, from the edge to the cloud."

Arm said it expects fourth-quarter revenue of $1.175 billion to $1.275 billion. The company anticipates fourth-quarter adjusted earnings of 48 cents to 56 cents per share. Arm also narrowed its full-year guidance. The company now expects full-year revenue of $3.94 billion to $4.04 billion and full-year adjusted earnings of $1.56 to $1.64 per share.

Arm shares gained 6.8% to close at $173.26 on Wednesday.

These analysts made changes to their price targets on Arm following earnings announcement.

- Goldman Sachs analyst Toshiya Hari maintained ARM Holdings with a Buy and raised the price target from $159 to $174..

- JP Morgan analyst Harlan Sur maintained ARM with an Overweight and raised the price target from $160 to $175.

- Jefferies analyst Janardan Menon maintained the stock with a Buy and raised the price target from $170 to $195.

- Mizuho analyst Vijay Rakesh maintained the stock with an Outperform and increased the price target from $160 to $180.

- Rosenblatt analyst Hans Mosesmann maintained ARM with a Buy and raised the price target from $180 to $225.

- Evercore ISI Group analyst Mark Lipacis maintained the stock with an Outperform and raised the price target from $176 to $202.

- Raymond James analyst Srini Pajjuri maintained ARM with an Outperform and raised the price target from $160 to $175.

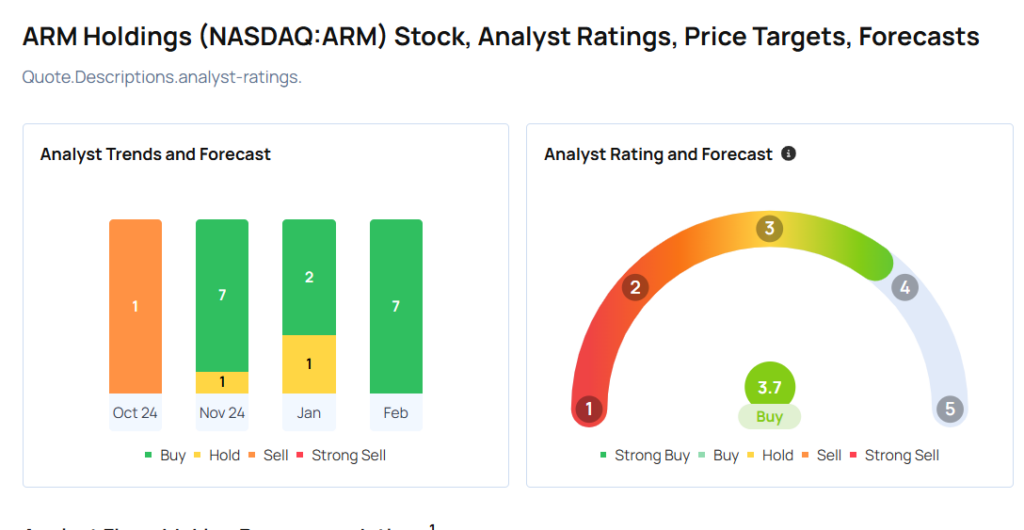

Considering buying ARM stock? Here’s what analysts think:

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10