Colgate-Palmolive Earnings Are Imminent; These Most Accurate Analysts Revise Forecasts Ahead Of Earnings Call

Colgate-Palmolive Company (NYSE:CL) will release earnings results for its fourth quarter before the opening bell on Friday, Jan. 31, 2025.

Analysts expect the New York-based company to report quarterly earnings at 89 cents per share, up from 87 cents per share in the year-ago period. Colgate-Palmolive projects to report revenue of $4.99 billion for the recent quarter, compared to $4.95 billion a year earlier, according to data from Benzinga Pro.

On Dec. 11, the company's Board of Directors declared a quarterly cash dividend of 50 cents per common share.

Colgate-Palmolive shares gained 1.5% to close at $90.89 on Thursday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

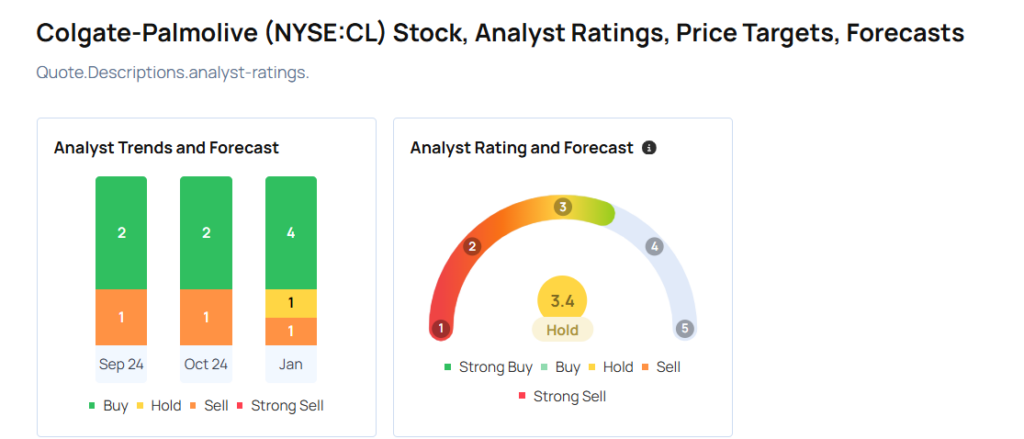

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- Stifel analyst Mark Astrachan maintained a Hold rating and cut the price target from $101 to $95 on Jan. 17, 2025. This analyst has an accuracy rate of 75%.

- TD Cowen analyst Robert Moskow maintained a Buy rating and slashed the price target from $110 to $100 on Jan. 8, 2025. This analyst has an accuracy rate of 67%.

- Wells Fargo analyst Chris Carey maintained an Underweight rating and lowered the price target from $92 to $83 on Jan. 7, 2025. This analyst has an accuracy rate of 61%.

- Deutsche Bank analyst Steve Powers downgraded the stock from Buy to Hold but boosted the price target from $107 to $109 on Sept. 9, 2024. This analyst has an accuracy rate of 67%.

- Morgan Stanley analyst Dara Mohsenian maintained an Overweight rating and increased the price target from $103 to $111 on July 29, 2024. This analyst has an accuracy rate of 70%.

Considering buying CL stock? Here’s what analysts think:

Read This Next:

- Jim Cramer Likes This Tech Stock: ‘Terrific Business, Niche Business’

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10