Coinbase Files to List Solana & Hedera Futures ETF

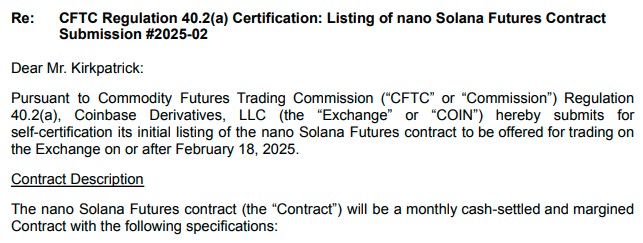

Coinbase Derivatives has filed to list new futures contracts for Solana (SOL) and Hedera (HBAR), according to filings on Thursday. The crypto exchange plans to launch these contracts, which will be cash-settled monthly, in February 2025 or later.

This move comes as Coinbase seeks to capitalize on the growing market sentiment and potential positive regulatory changes under the Trump Administration. Other major players, like CME, are also preparing to offer futures for Solana and XRP in the near future.

Asset management firms VanEck and ProShares continue to file applications for crypto ETFs that would enable trading Litecoin alongside XRP and Solana. The June 2021 launch of Coinbase Derivatives brought a new trading platform under Commodity Futures Trading Commission (CFTC) regulation as a “designated contract market.”

Through Coinbase Derivatives users can execute trades for crypto derivatives which include futures contracts that cover digital assets including Bitcoin (BTC) and Ethereum (ETH). The upcoming Solana futures contracts will operate with a 100 SOL size which equals approximately $24,000 in value if they receive regulatory approval.

Trading operations will terminate at 4:00 PM London time during the final Friday of the monthly contract period. Coinbase will launch “nano” Solana contracts that have a value of five SOL. The Hedera futures contract will monitor 5,000 Hedera tokens.

Nodal Clear, LLC which operates as a CFTC-registered derivatives clearing organization will clear these contracts. The new nano Solana contract at Coinbase receives broad backing from users while facing minimal opposition according to the company.

The company adopts this move as part of its market expansion strategy for crypto derivatives alongside rising digital asset demand.

Also Read: Coinbase CEO Apologizes for Delayed Solana Transactions

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10