JD Logistics (SEHK:2618) Eyes Growth with Taobao and Tmall Alliances Despite Rising Employee Costs

Navigate through the intricacies of JD Logistics with our comprehensive report here.

Key Assets Propelling JD Logistics Forward

JD Logistics has demonstrated impressive financial performance, with total revenue reaching RMB 44.4 billion, a 6.6% increase year-over-year, as noted by CEO Wei Hu. This growth is coupled with a non-IFRS net profit of RMB 2.57 billion, nearly tripling from the same period last year, and a net profit margin increase to 5.8%. Such figures underscore the company's operational efficiency and profitability. Additionally, the expansion of its customer base, with external ISC customers growing by 9.4% to 59,000, highlights its strategic capability in tailoring services across industries. Technological innovation remains a cornerstone, with the integration of logistics large language models enhancing process automation and interaction, further solidifying its competitive edge.

To gain deeper insights into JD Logistics's historical performance, explore our detailed analysis of past performance.

Strategic Gaps That Could Affect JD Logistics

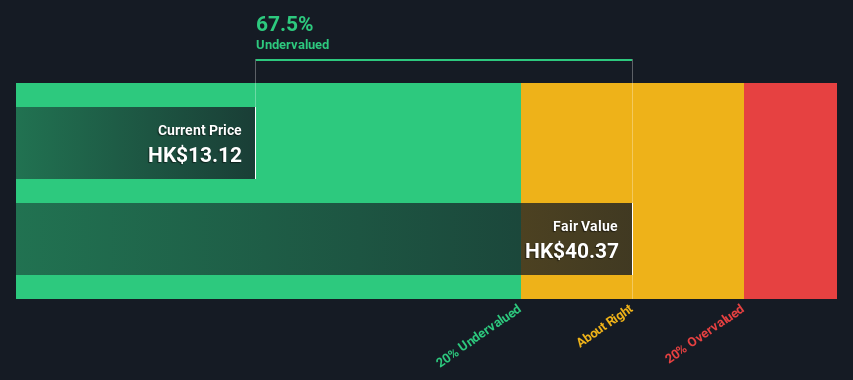

JD Logistics faces certain challenges. Employee benefit expenses rose by 4.8% to RMB 14.6 billion, indicating cost pressures from workforce expansion, as CFO Hao Wu pointed out. This could strain operational margins if not managed effectively. Furthermore, the home appliance segment, while profitable, does not contribute significantly to revenue growth due to its slower turnover compared to faster-moving segments. Additionally, the company's forecasted revenue growth of 7.6% lags behind the Hong Kong market's 7.8%, potentially impacting its market position. The company's trading at a Price-To-Earnings Ratio of 15x is notably lower than the industry average of 17.4x and peer average of 29.6x, suggesting a potential disconnect with market expectations.

To learn about how JD Logistics's valuation metrics are shaping its market position, check out our detailed analysis of JD Logistics's Valuation.

Potential Strategies for Leveraging Growth and Competitive Advantage

JD Logistics is poised to capitalize on international expansion, with new warehouses in Malaysia and the United States and plans to double its overseas warehouse space by 2025. This move opens doors to significant growth in global markets. The integration with Taobao and Tmall Group exemplifies strategic partnerships, allowing JD Logistics to serve all major e-commerce platforms in China, thereby enhancing its market share. Furthermore, diversifying product and service offerings through collaborations with leading e-commerce platforms can drive additional business growth, as highlighted by Hao Wu. These initiatives position JD Logistics to leverage emerging opportunities effectively.

See what the latest analyst reports say about JD Logistics's future prospects and potential market movements.

Regulatory Challenges Facing JD Logistics

However, the company must navigate several external threats. The logistics and delivery sector is fiercely competitive, which could pressure JD Logistics' margins and market share if competitors enhance their offerings. Economic fluctuations and regulatory changes pose additional challenges, potentially impacting operational costs and strategic growth plans. Furthermore, while partnerships with major platforms like Taobao and Tmall are beneficial, reliance on these key relationships could be risky if they change or dissolve. Such dynamics require careful strategic planning to mitigate potential impacts on JD Logistics' growth trajectory.

Explore the current health of JD Logistics and how it reflects on its financial stability and growth potential.Conclusion

JD Logistics has shown significant financial growth, with a notable increase in revenue and profit margins, driven by strategic customer base expansion and technological advancements. However, challenges such as rising employee costs and slower growth in certain segments could impact future profitability if not addressed. The company's international expansion and strategic partnerships present opportunities for further growth, but the competitive and regulatory environment requires careful navigation. JD Logistics' current Price-To-Earnings Ratio of 15x suggests market undervaluation, indicating potential upside as the company continues to leverage its strengths and address its strategic gaps.

Next Steps

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10