Despite Bitcoin Nearing The $100,000 Mark, Roubini Labels It “Worthless,” Claiming Prices Are Manipulated

- Roubini’s stance remains firm despite Bitcoin’s recovery, viewing it as a “pseudo-asset” with no intrinsic value.

- Unlike Michael Saylor, who became a Bitcoin advocate, Roubini aligns with Peter Schiff in steadfast crypto skepticism.

Nouriel Roubini, a prominent economist known for his critical view on cryptocurrencies, continues to express skepticism towards Bitcoin despite its recent price surges. Roubini, who predicted the global financial crisis in the late 2000s, maintains that Bitcoin lacks the essential functions and scalability to be considered a viable currency or a unit of account.

ETF IQ: Nouriel Roubini (Still) Doesn’t Like Cryptocurrencies https://t.co/tJpRcOlUcz

— Bloomberg Crypto (@crypto) November 29, 2024

According to Roubini, Bitcoin’s failure to provide sufficient scalability prevents it from being practical for regular transactions. Despite Bitcoin’s increasing competition with gold in terms of market share, Roubini also disputes its classification as a store of value.

He has previously labeled Bitcoin as “worthless,” suggesting that its market price is artificially inflated through manipulation.

In 2021, Roubini criticized institutional investors involved with Bitcoin, asserting that engaging with the cryptocurrency was reckless and grounds for dismissal. His stance seemed to find validation during Bitcoin’s significant price drop in early 2022, which he highlighted with evident satisfaction on social media.

“Bitcoin is now at 36K, almost 50% down from its November ATH. So much for those who predicted that by now it would be at 100k, 200k, 400k. And it must be painful to be so rekt for all retail suckers who bought it in the frenzy when it was 69k last fall while whales dumped it!” he said.

Roubini pointed out the dramatic fall from Bitcoin’s peak price, emphasizing the losses incurred by retail investors who entered the market during its high.

Despite Bitcoin’s recovery and its approach to the $100,000 milestone, Roubini remains unswayed. He continues to argue that Bitcoin is a “pseudo-asset” with no intrinsic value.

This perspective aligns him with other steadfast cryptocurrency critics like Peter Schiff, despite the growing number of former skeptics, such as MicroStrategy co-founder Michael Saylor, who have become major proponents of Bitcoin.

Unlike Saylor, who reversed his stance and now champions Bitcoin, Roubini and Schiff stand firm in their critical views, regardless of market trends or popular sentiment.

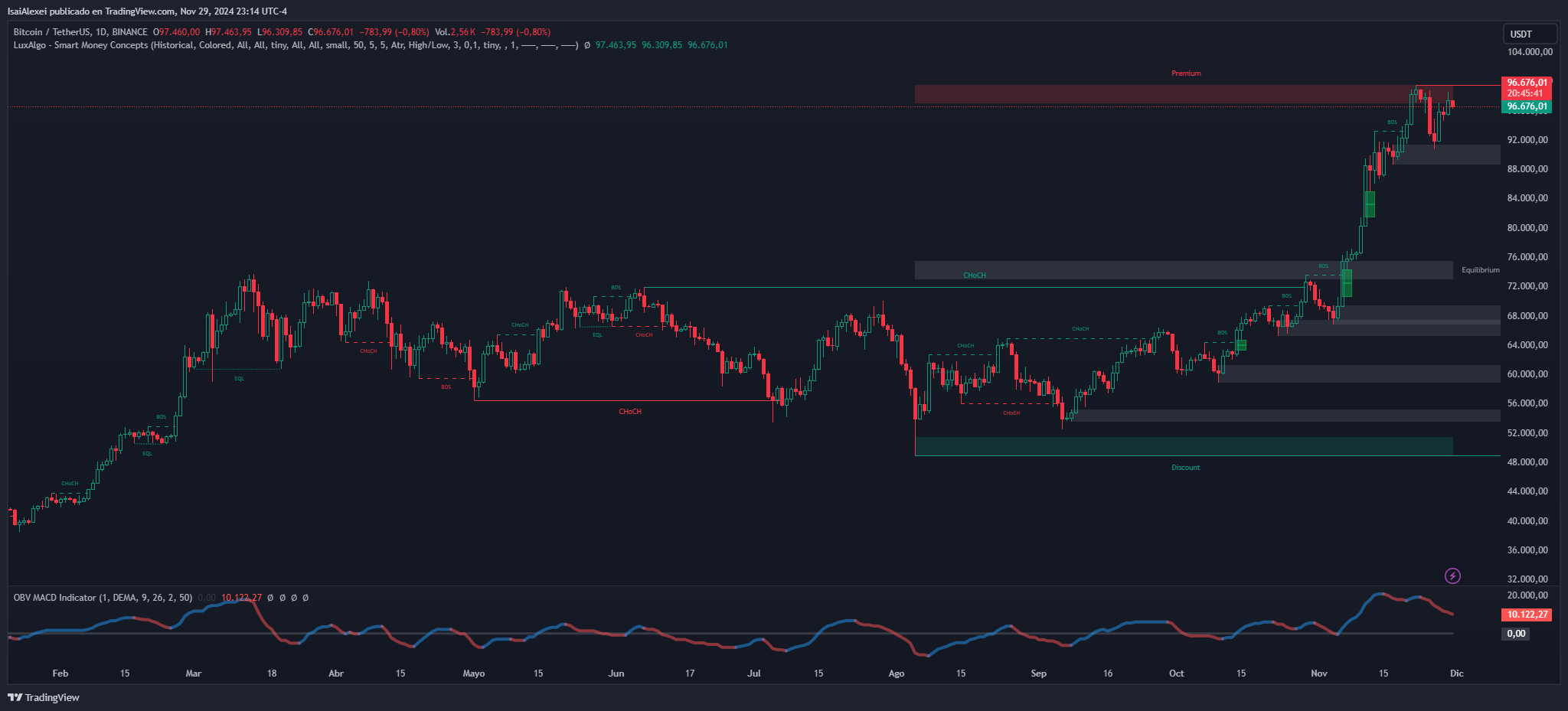

Bitcoin (BTC) is currently trading at $96,682 USD, reflecting a daily decline of 0.85%. Over the past month, BTC has gained 33.64%, and its year-to-date increase stands at 128.74%, showcasing robust long-term bullish momentum.

Despite its recent pullback, Bitcoin is consolidating near key resistance levels as it eyes the critical psychological milestone of $100,000 USD.

Based on the BTC/USDT chart, Bitcoin is consolidating below the premium zone at $96,676 USD, showing signs of hesitation near critical resistance.

The price is currently trading within a bullish structure, having established higher highs (HH) and higher lows (HL), supported by strong demand during recent pullbacks.

Key Levels:

Resistance:

- $98,000 – $100,000 USD (Premium Zone): A strong resistance zone where significant profit-taking is likely. A breakout above this area would confirm further bullish momentum.

- Support:

- $92,000 USD: Immediate support where buyers previously defended positions. A failure here could lead to a deeper retracement.

- $88,000 – $90,000 USD: A strong demand zone aligning with the equilibrium level and previous consolidation.

Discount Zone:

- $75,000 – $80,000 USD: A deeper retracement could target this zone for potential long re-entries, where institutional buying may reappear.

Market Structure:

- CHoCH (Change of Character): Multiple CHoCH events indicate that bulls are firmly in control. However, current price action shows consolidation, signaling indecision before a possible breakout or pullback.

MACD Indicator:

- The MACD line remains positive but is showing signs of flattening, suggesting momentum is weakening near resistance.

The post Despite Bitcoin Nearing The $100,000 Mark, Roubini Labels It “Worthless,” Claiming Prices Are Manipulated appeared first on ETHNews.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10