Crypto Whales Cash Out After MANTRA (OM) 160% Price Increase Lead to New All-Time High

- MANTRA (OM) surged to a new all-time high but retraced to $3.86 as whales booked profits, reflected in decreased netflow.

- Network growth dropped, indicating a struggle to attract new demand, which could limit OM’s ability to sustain an uptrend.

- With RSI in overbought territory, OM might drop to $3.20 or even $2.58; renewed whale buying could push it to $4.54.

On Monday, November 18, MANTRA (OM) rallied to a new all-time high after the price increased by 160% in the last 24 hours. Following the landmark, crypto whales have booked some profits.

This action has caused OM’s price to retrace. But will the price continue to decrease, or is a rebound on the cards?

MANTRA Sees Increase in Profit-Taking, Decrease in Demand

Based on IntoTheBlock’s data, MANTRA’s large holders netflow has decreased in the last 24 hours. This metric tracks the activity of addresses that hold between 0.1% and 1% of a cryptocurrency.

When the metric rises, it means that crypto whales have bought more tokens compared to the ones sold. On the other hand, when the netflow drops, it means that whales have sold more tokens

In this case, it appears that MANTRA whales capitalized on the altcoin’s price rally to take out some gains. As a result, OM’s price has decreased from $4.47 to $3.86. Should whales continue to sell, then the token’s value might continue to drop.

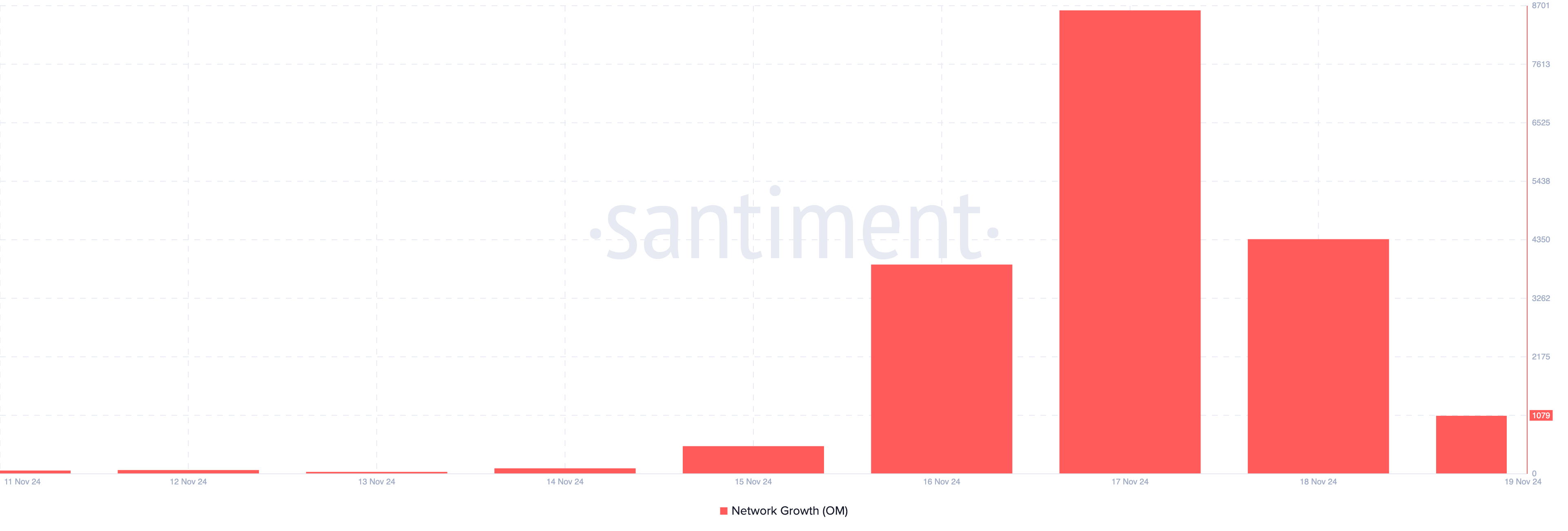

In addition, on-chain data from Santiment reveals a significant drop in the project’s network growth. For context, network growth measures the number of new addresses created and successfully transacting on the blockchain.

An increase in this metric typically signals growing demand for the token, which can drive its price higher. However, the current decline suggests that OM is struggling to attract new demand. If this trend continues, it could hinder the altcoin’s ability to sustain upward price movement.

OM Price Prediction: Altcoin Overbought

According to the daily chart, OM’s price faced resistance at $4.23, causing the altcoin’s value to drop to $3.85. Also, the Relative Strength Index (RSI) has risen above the 70.00 region, indicating that the token is overbought.

The RSI is a widely used technical indicator for measuring momentum. It measures the speed and magnitude of a cryptocurrency’s recent price changes to identify whether it is overbought or oversold.

When the reading is less than 30.00, it is oversold. But since it is above 70.00, it means that MANTRA’s price is overbought. As such, the price of the Real-World Assets project could experience a drawdown to $3.20.

In a highly bearish scenario, the token could drop to $2.58. On the other hand, if MANTRA whales begin to buy again, this sentiment might change. In that scenario, OM could rise to $4.54.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10