### 3 SGX Stocks Possibly Trading At Up To 43.4% Below Intrinsic Value

The Singapore market has been navigating a period of volatility, with notable movements in individual stocks contrasting against broader index trends. Amid these fluctuations, identifying undervalued stocks can offer significant opportunities for investors seeking value. In this article, we will explore three SGX-listed companies that are potentially trading up to 43.4% below their intrinsic value, highlighting what makes them attractive in the current market landscape.

Top 5 Undervalued Stocks Based On Cash Flows In Singapore

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Singapore Technologies Engineering (SGX:S63) | SGD4.60 | SGD7.30 | 36.9% |

| Digital Core REIT (SGX:DCRU) | US$0.61 | US$0.82 | 26% |

| Nanofilm Technologies International (SGX:MZH) | SGD0.805 | SGD1.42 | 43.4% |

| Frasers Logistics & Commercial Trust (SGX:BUOU) | SGD1.15 | SGD1.59 | 27.6% |

| Seatrium (SGX:5E2) | SGD1.75 | SGD2.96 | 40.9% |

Click here to see the full list of 5 stocks from our Undervalued SGX Stocks Based On Cash Flows screener.

Let's explore several standout options from the results in the screener.

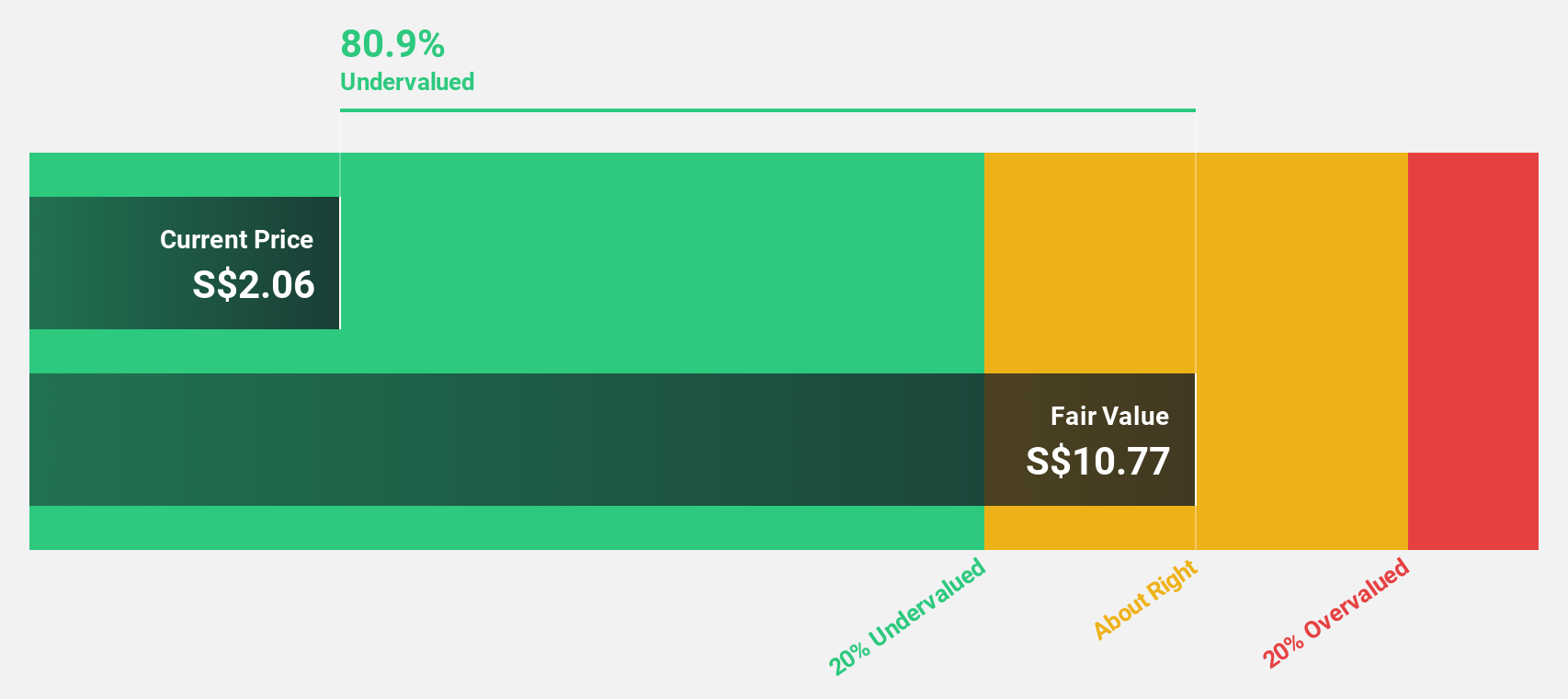

Seatrium (SGX:5E2)

Overview: Seatrium Limited offers engineering solutions to the offshore, marine, and energy industries and has a market cap of SGD5.95 billion.

Operations: The company's revenue segments include Ship Chartering at SGD24.71 million and Rigs & Floaters, Repairs & Upgrades, Offshore Platforms, and Specialised Shipbuilding at SGD8.39 billion.

Estimated Discount To Fair Value: 40.9%

Seatrium is trading at S$1.75, significantly below its estimated fair value of S$2.96, suggesting it may be undervalued based on cash flows. Analysts forecast revenue growth of 7.1% per year, outpacing the Singapore market average of 3.6%. Recent positive developments include a net profit for H1 2024 and the early delivery of its fourth jackup rig to Borr Drilling, highlighting operational efficiency and project execution capabilities.

- In light of our recent growth report, it seems possible that Seatrium's financial performance will exceed current levels.

- Take a closer look at Seatrium's balance sheet health here in our report.

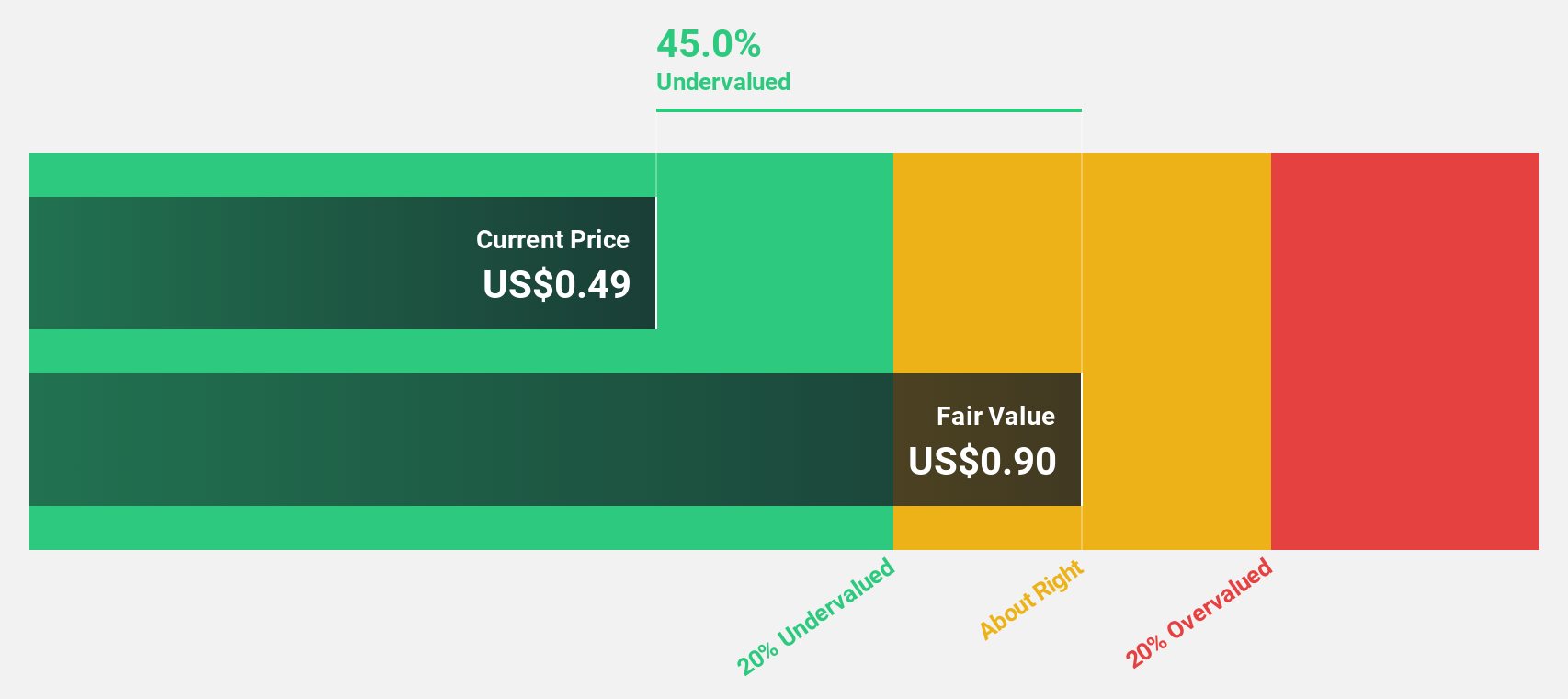

Digital Core REIT (SGX:DCRU)

Overview: Digital Core REIT (SGX: DCRU) is a leading pure-play data centre REIT listed in Singapore, sponsored by Digital Realty, with a market cap of approximately $790.90 million.

Operations: Revenue from the commercial REIT segment for Digital Core REIT (SGX: DCRU) totals $70.76 million.

Estimated Discount To Fair Value: 26%

Digital Core REIT, trading at US$0.61, is highly undervalued with an estimated fair value of US$0.82 and expected annual profit growth above market averages over the next three years. Despite a recent decrease in distribution per unit and shareholder dilution, the company reported improved net income for H1 2024 (US$18.63 million vs. US$9.07 million year-on-year). Revenue is forecast to grow 12% annually, outpacing the Singapore market average of 3.6%.

- The analysis detailed in our Digital Core REIT growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of Digital Core REIT.

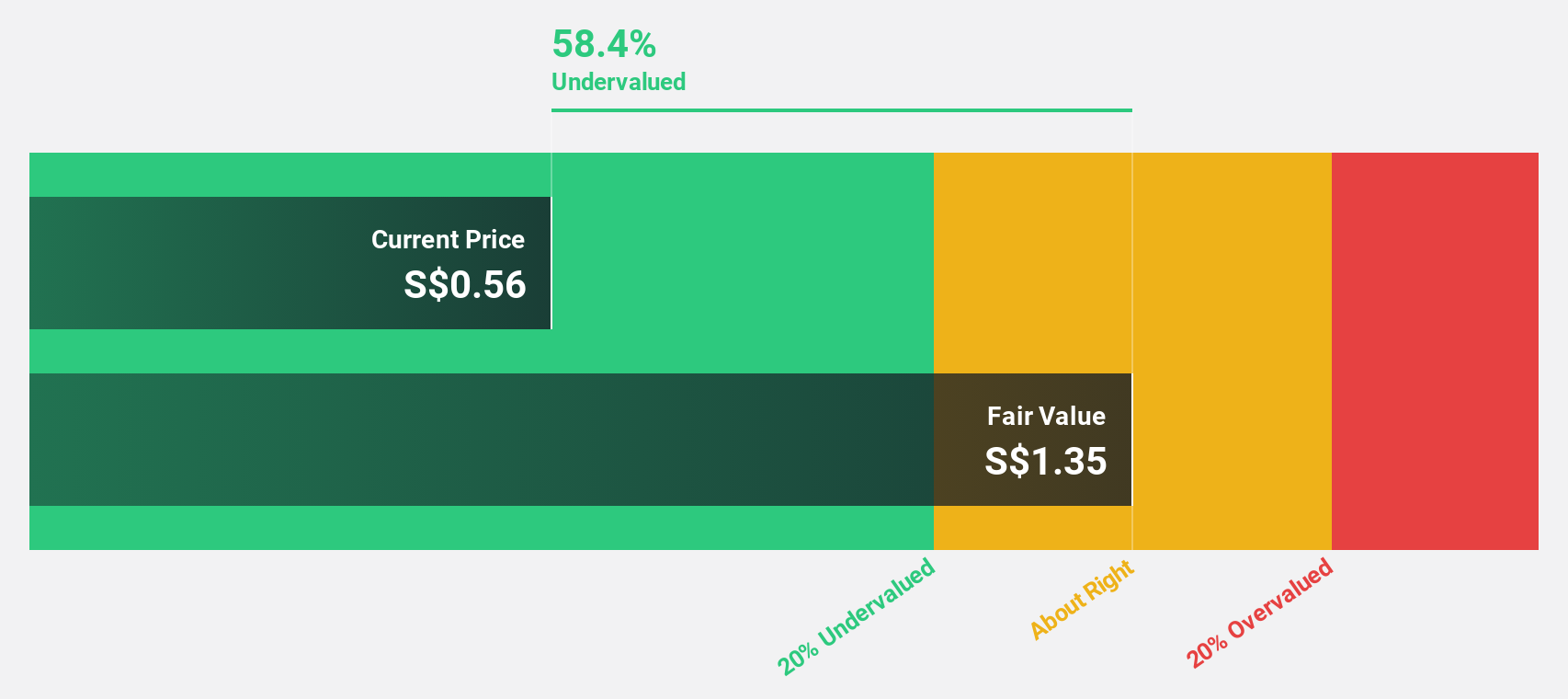

Nanofilm Technologies International (SGX:MZH)

Overview: Nanofilm Technologies International Limited, with a market cap of SGD524.12 million, offers nanotechnology solutions across Singapore, China, Japan, and Vietnam.

Operations: The company's revenue segments include Sydrogen (SGD1.40 million), Nanofabrication (SGD18.37 million), Advanced Materials (SGD153.32 million), and Industrial Equipment (SGD28.71 million).

Estimated Discount To Fair Value: 43.4%

Nanofilm Technologies International, trading at SGD 0.81, is significantly undervalued with an estimated fair value of SGD 1.42. Despite reporting a net loss of SGD 3.74 million for H1 2024, the company’s earnings are forecast to grow by over 50% annually for the next three years, outpacing market averages. Recent board changes and dividend affirmations indicate ongoing corporate restructuring and commitment to shareholder returns amidst anticipated revenue growth of 16% per year.

- Our earnings growth report unveils the potential for significant increases in Nanofilm Technologies International's future results.

- Dive into the specifics of Nanofilm Technologies International here with our thorough financial health report.

Turning Ideas Into Actions

- Dive into all 5 of the Undervalued SGX Stocks Based On Cash Flows we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10