Seatrium And 2 Other SGX Stocks That Might Be Trading Below Their Estimated Value

The Singapore market has been experiencing a mix of cautious optimism and strategic realignments, with investors closely monitoring key economic indicators and corporate transactions. In this environment, identifying undervalued stocks can be particularly rewarding as they offer the potential for significant upside when market conditions stabilize or improve.

Top 5 Undervalued Stocks Based On Cash Flows In Singapore

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Singapore Technologies Engineering (SGX:S63) | SGD4.69 | SGD7.32 | 35.9% |

| Digital Core REIT (SGX:DCRU) | US$0.615 | US$0.83 | 25.6% |

| Nanofilm Technologies International (SGX:MZH) | SGD0.825 | SGD1.43 | 42.3% |

| Frasers Logistics & Commercial Trust (SGX:BUOU) | SGD1.15 | SGD1.59 | 27.6% |

| Seatrium (SGX:5E2) | SGD1.74 | SGD2.96 | 41.2% |

Click here to see the full list of 5 stocks from our Undervalued SGX Stocks Based On Cash Flows screener.

Let's uncover some gems from our specialized screener.

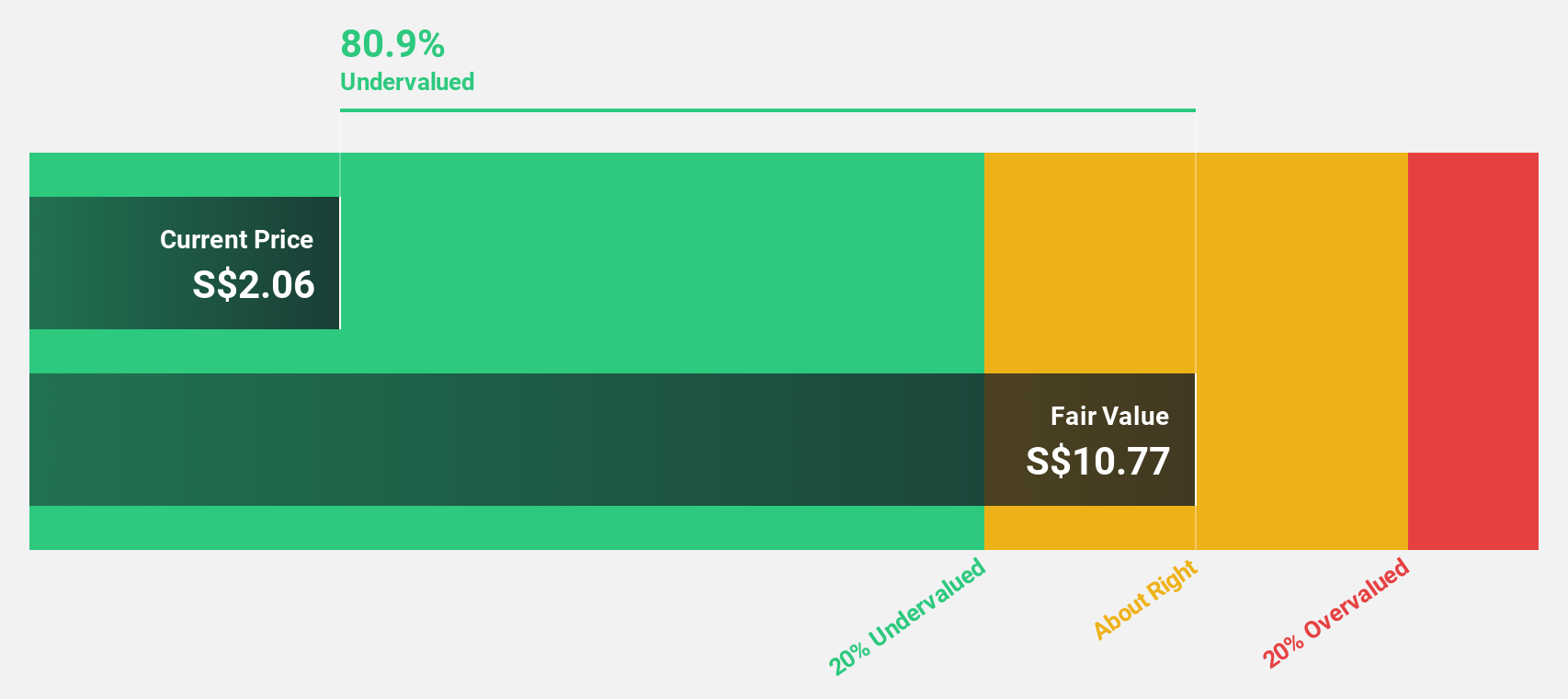

Seatrium (SGX:5E2)

Overview: Seatrium Limited offers engineering solutions to the offshore, marine, and energy industries with a market cap of SGD5.91 billion.

Operations: The company's revenue segments include Ship Chartering at SGD24.71 million and Rigs & Floaters, Repairs & Upgrades, Offshore Platforms, and Specialised Shipbuilding at SGD8.39 billion.

Estimated Discount To Fair Value: 41.2%

Seatrium is trading at S$1.74, significantly below its estimated fair value of S$2.96, indicating it may be undervalued based on cash flows. The company has shown strong earnings growth, reporting a net income of S$35.97 million for H1 2024 compared to a loss last year. Recent successful project completions and share buybacks further bolster its financial position and operational credibility, suggesting potential for future profitability and revenue growth.

- Our growth report here indicates Seatrium may be poised for an improving outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Seatrium.

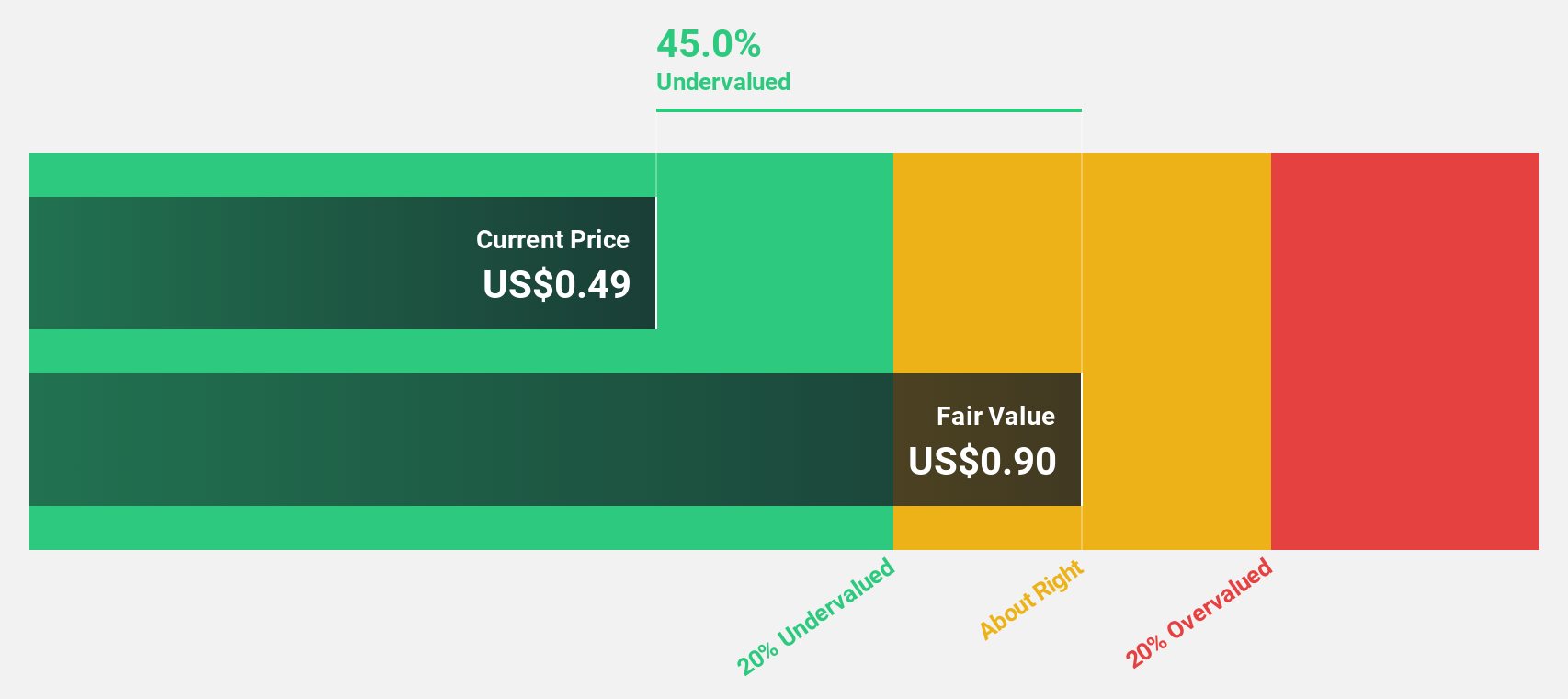

Digital Core REIT (SGX:DCRU)

Overview: Digital Core REIT (SGX: DCRU) is a leading pure-play data centre REIT listed in Singapore, sponsored by Digital Realty, with a market cap of $797.54 million.

Operations: The company's revenue primarily comes from its commercial REIT segment, generating $70.76 million.

Estimated Discount To Fair Value: 25.6%

Digital Core REIT, trading at US$0.62, is significantly undervalued with an estimated fair value of US$0.83. Despite a recent decrease in revenue to US$48.26 million for H1 2024 from US$53.39 million a year ago, net income rose to US$18.63 million from US$9.07 million, indicating improved profitability metrics. However, the dividend track record remains unstable and shareholders experienced dilution over the past year.

- The growth report we've compiled suggests that Digital Core REIT's future prospects could be on the up.

- Click here to discover the nuances of Digital Core REIT with our detailed financial health report.

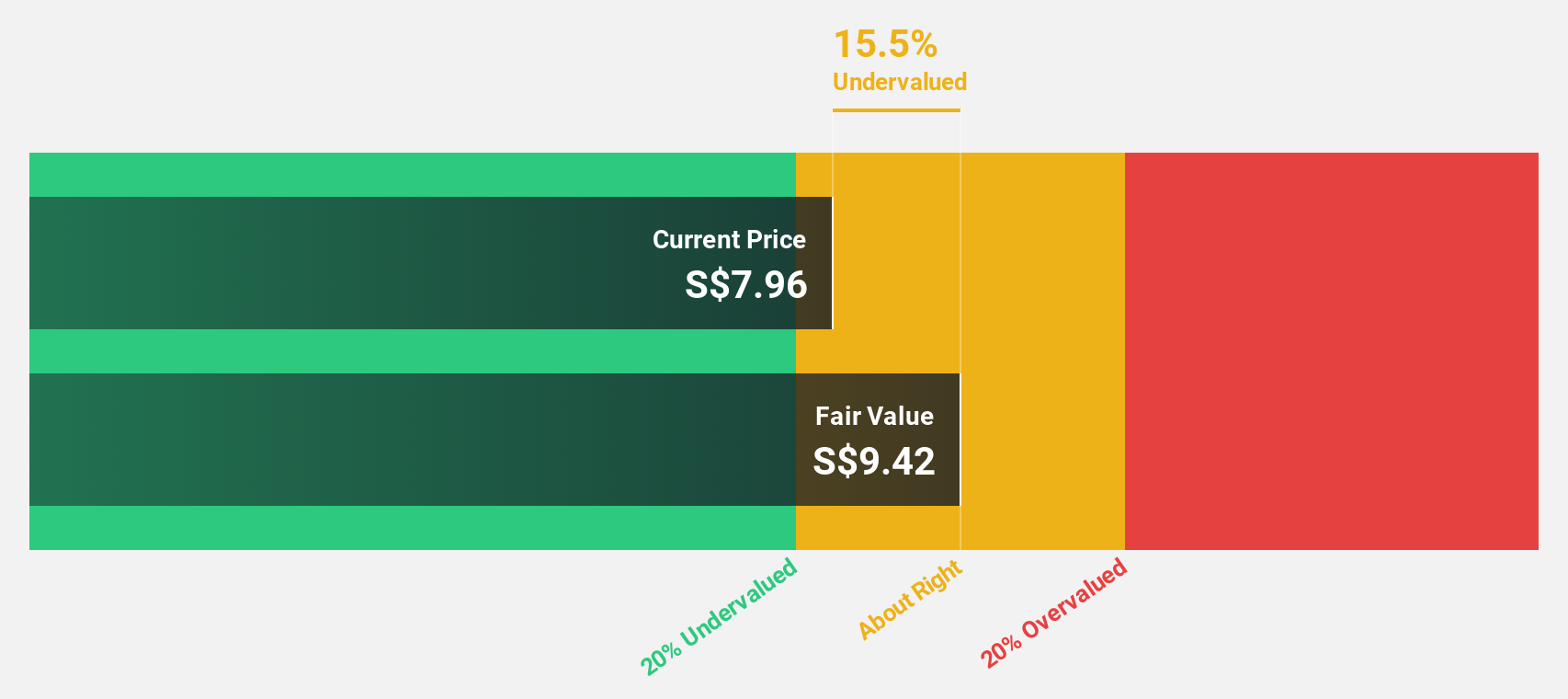

Singapore Technologies Engineering (SGX:S63)

Overview: Singapore Technologies Engineering Ltd operates as a global technology, defence, and engineering company with a market cap of SGD14.62 billion.

Operations: The company's revenue segments include Commercial Aerospace (SGD4.34 billion), Urban Solutions & Satcom (SGD2.01 billion), and Defence & Public Security (SGD4.54 billion).

Estimated Discount To Fair Value: 35.9%

Singapore Technologies Engineering (ST Engineering) is trading at SGD 4.69, significantly below its estimated fair value of SGD 7.32. The company reported strong earnings growth of 19.9% over the past year, with revenue for H1 2024 at SGD 5.52 billion and net income at SGD 336.53 million, up from the previous year. A recent strategic alliance with Toshiba Digital Solutions Corporation aims to enhance quantum-secure communications solutions, potentially bolstering future cash flows despite an unstable dividend track record and debt not well covered by operating cash flow.

- According our earnings growth report, there's an indication that Singapore Technologies Engineering might be ready to expand.

- Navigate through the intricacies of Singapore Technologies Engineering with our comprehensive financial health report here.

Taking Advantage

- Explore the 5 names from our Undervalued SGX Stocks Based On Cash Flows screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10