Exploring TeraWulf And Two Other High Growth Tech Stocks

The market is up 1.2% over the last week and has risen 30% over the past 12 months, with earnings forecast to grow by 15% annually. In this favorable environment, identifying high-growth tech stocks like TeraWulf can be crucial for investors looking to capitalize on robust market conditions and promising future earnings potential.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 20.81% | 27.98% | ★★★★★★ |

| TG Therapeutics | 28.39% | 43.54% | ★★★★★★ |

| Sarepta Therapeutics | 23.58% | 44.12% | ★★★★★★ |

| Invivyd | 42.91% | 70.39% | ★★★★★★ |

| Ardelyx | 27.46% | 66.34% | ★★★★★★ |

| Amicus Therapeutics | 20.32% | 62.37% | ★★★★★★ |

| Clene | 71.89% | 60.05% | ★★★★★★ |

| Travere Therapeutics | 26.68% | 68.80% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 251 stocks from our US High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

TeraWulf (NasdaqCM:WULF)

Simply Wall St Growth Rating: ★★★★★☆

Overview: TeraWulf Inc., along with its subsidiaries, operates as a digital asset technology company in the United States and has a market cap of $1.72 billion.

Operations: The company generates revenue primarily through digital currency mining, with a reported revenue of $120.25 million. The market capitalization stands at approximately $1.72 billion.

TeraWulf, amidst a volatile market, is navigating through its unprofitability with strategic maneuvers aimed at robust future growth. With an impressive revenue forecast growing at 53.1% annually, it outpaces the broader US market's 8.7% growth expectation. This surge is underpinned by significant R&D investment, crucial for staying competitive in tech-intensive sectors like AI and high-performance computing. Recent operational highlights include mining 184 bitcoins in August alone while efficiently managing production costs despite challenging economic conditions. Moreover, their proactive financial strategies are evident from the recent auditor change to Deloitte and full repayment of their term loan, positioning them for sustainable expansion and potentially profitable years ahead as forecasted earnings growth hits a remarkable 108.6% annually.

- Take a closer look at TeraWulf's potential here in our health report.

Review our historical performance report to gain insights into TeraWulf's's past performance.

Sarepta Therapeutics (NasdaqGS:SRPT)

Simply Wall St Growth Rating: ★★★★★★

Overview: Sarepta Therapeutics, Inc. is a commercial-stage biopharmaceutical company specializing in RNA-targeted therapeutics, gene therapies, and other genetic therapeutic modalities for rare diseases, with a market cap of $12.13 billion.

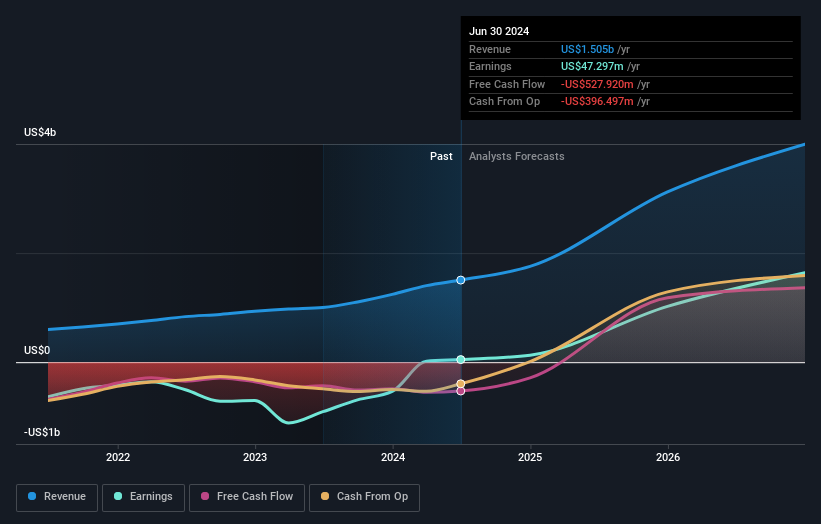

Operations: Sarepta Therapeutics focuses on discovering, developing, manufacturing, and delivering RNA-targeted therapeutics and gene therapies for rare diseases. The company generated $1.50 billion in revenue from these activities.

Sarepta Therapeutics, showcasing resilience and strategic foresight, has pivoted from a net loss to a notable net income of $42.58 million in the first half of 2024, signaling robust operational improvements. This turnaround is anchored by a 44.1% anticipated annual profit growth, outstripping the broader market's expectations significantly. The firm also projects an aggressive revenue trajectory with an increase forecasted at 23.6% annually through 2025, emphasizing its commitment to innovation and market expansion amidst recent enhancements in governance and executive leadership that promise to bolster its strategic direction further.

- Dive into the specifics of Sarepta Therapeutics here with our thorough health report.

Gain insights into Sarepta Therapeutics' historical performance by reviewing our past performance report.

VNET Group (NasdaqGS:VNET)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: VNET Group, Inc. is an investment holding company that provides hosting and related services in China with a market cap of approximately $913.02 million.

Operations: The company generates revenue primarily from hosting and related services, amounting to CN¥7677.29 million. With a market cap of approximately $913.02 million, its core business is centered in China.

VNET Group, navigating through a transformative phase, has reaffirmed its 2024 revenue outlook with expectations to hit between RMB 7.8 billion and RMB 8 billion, marking up to an 7.9% increase from the previous year. This projection is bolstered by a robust pipeline of innovations and strategic board reshuffles aimed at deepening its tech footprint across global markets. Notably, the company's commitment to research and development is evident from its planned expenditure in this area, which underscores its strategy to stay ahead in competitive technology realms by enhancing product offerings and optimizing operational efficiencies.

- Unlock comprehensive insights into our analysis of VNET Group stock in this health report.

Evaluate VNET Group's historical performance by accessing our past performance report.

Summing It All Up

- Click this link to deep-dive into the 251 companies within our US High Growth Tech and AI Stocks screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TeraWulf might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10