High Growth Tech in Hong Kong Featuring 3 Prominent Stocks

In recent weeks, the Hong Kong market has faced a mix of global economic pressures and local challenges, with indices such as the Hang Seng Index experiencing fluctuations due to weak inflation data and broader market sentiment. Despite these headwinds, technology stocks have shown resilience and potential for high growth, making them an intriguing focus for investors. When evaluating high-growth tech stocks in such a dynamic environment, it's crucial to consider factors like innovation potential, market demand for technology solutions, and the company's ability to adapt to changing economic conditions.

Top 10 High Growth Tech Companies In Hong Kong

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Wasion Holdings | 22.37% | 25.47% | ★★★★★☆ |

| MedSci Healthcare Holdings | 48.74% | 48.78% | ★★★★★☆ |

| Inspur Digital Enterprise Technology | 25.37% | 39.10% | ★★★★★☆ |

| RemeGen | 26.30% | 52.19% | ★★★★★☆ |

| Akeso | 33.07% | 54.67% | ★★★★★★ |

| Cowell e Holdings | 31.82% | 35.43% | ★★★★★★ |

| Innovent Biologics | 22.35% | 59.39% | ★★★★★☆ |

| Biocytogen Pharmaceuticals (Beijing) | 21.53% | 109.17% | ★★★★★☆ |

| Beijing Airdoc Technology | 37.47% | 93.35% | ★★★★★☆ |

| Sichuan Kelun-Biotech Biopharmaceutical | 24.70% | 8.53% | ★★★★★☆ |

Click here to see the full list of 45 stocks from our SEHK High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Kuaishou Technology (SEHK:1024)

Simply Wall St Growth Rating: ★★★★☆☆

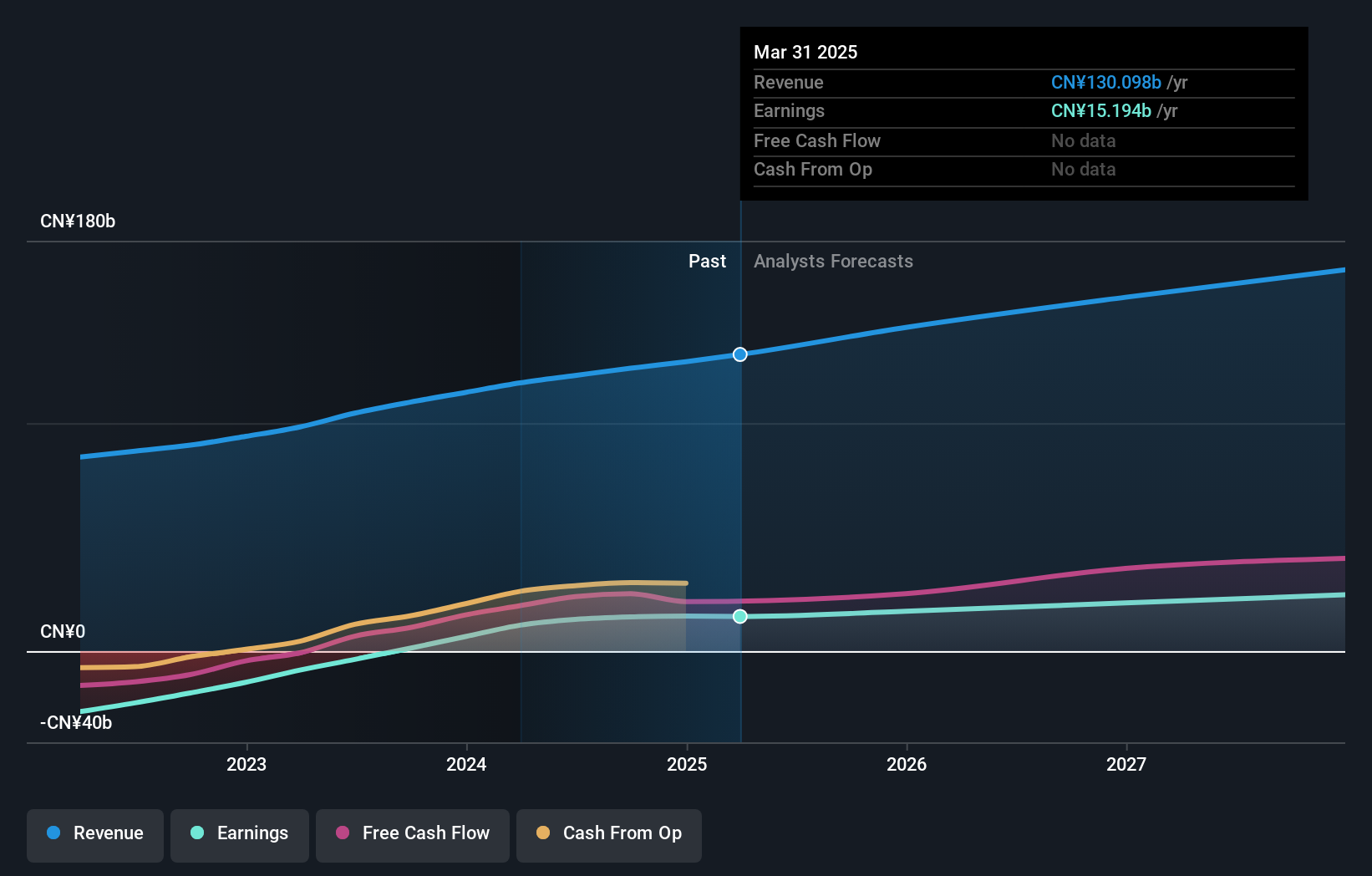

Overview: Kuaishou Technology, an investment holding company, provides live streaming, online marketing, and other services in the People’s Republic of China with a market cap of HK$173.22 billion.

Operations: Kuaishou Technology generates revenue primarily from domestic operations (CN¥117.32 billion) and overseas markets (CN¥3.57 billion). The company focuses on live streaming and online marketing services within China.

Kuaishou Technology's recent earnings report highlights robust growth, with Q2 sales reaching ¥30.98 billion, up from ¥27.74 billion the previous year, and net income soaring to ¥3.98 billion from ¥1.48 billion. The company's R&D expenses are significant, reflecting a commitment to innovation; in 2023 alone, they invested 18.8% of their revenue into R&D efforts. Notably, Kuaishou's Kling AI video generation model has seen substantial upgrades and user engagement, positioning it as a leader in AI-driven content creation.

- Get an in-depth perspective on Kuaishou Technology's performance by reading our health report here.

Gain insights into Kuaishou Technology's past trends and performance with our Past report.

Tencent Holdings (SEHK:700)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Tencent Holdings Limited, an investment holding company, provides a range of services including value-added services (VAS), online advertising, fintech, and business solutions both in China and globally, with a market cap of HK$3.50 trillion.

Operations: Tencent Holdings Limited generates revenue primarily from value-added services (CN¥302.28 billion), fintech and business services (CN¥209.17 billion), and online advertising (CN¥111.89 billion). The company's diverse portfolio spans various sectors, contributing to its substantial market presence both domestically and internationally.

Tencent Holdings' recent performance showcases strong growth, with Q2 revenue rising to ¥161.12 billion from ¥149.21 billion a year ago and net income increasing to ¥47.63 billion from ¥26.17 billion. The company has invested significantly in R&D, allocating 8.2% of its revenue towards innovation efforts, which is crucial for maintaining its competitive edge in the tech industry. Additionally, Tencent repurchased shares this year, reflecting confidence in its long-term prospects amidst a rapidly evolving market landscape.

- Click here and access our complete health analysis report to understand the dynamics of Tencent Holdings.

Examine Tencent Holdings' past performance report to understand how it has performed in the past.

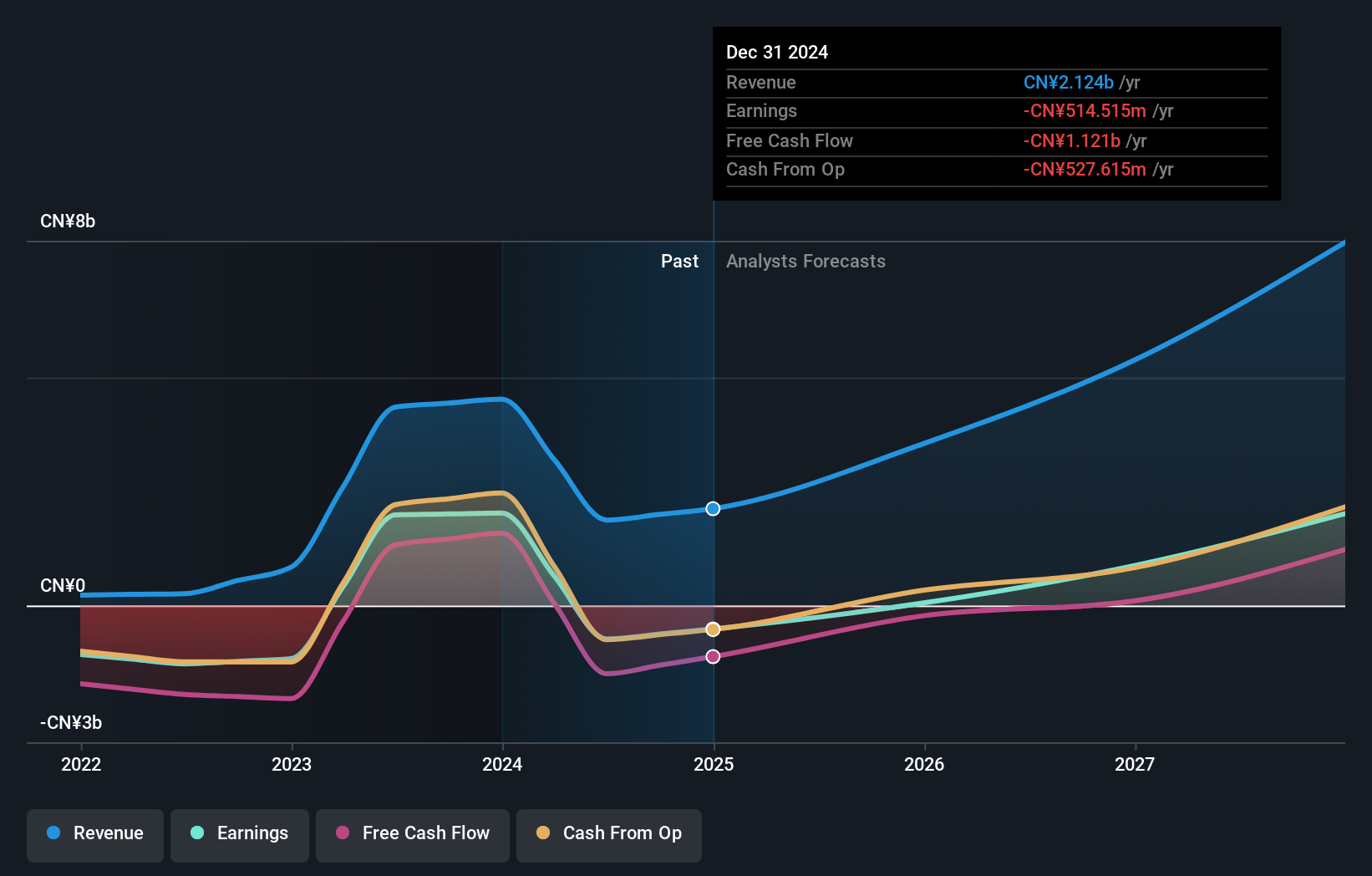

Akeso (SEHK:9926)

Simply Wall St Growth Rating: ★★★★★★

Overview: Akeso, Inc. is a biopharmaceutical company that focuses on the research, development, manufacturing, and commercialization of antibody drugs with a market cap of approximately HK$62.51 billion.

Operations: Akeso, Inc. generates revenue primarily from the research, development, production, and sale of biopharmaceutical products amounting to CN¥1874.14 million. The company operates within the biopharmaceutical sector with a focus on antibody drugs.

Akeso's innovative approach in biotech is underscored by its significant R&D investment, constituting 33.1% of revenue, propelling advancements like ivonescimab for TNBC and mCRC treatments. Recent phase 2 results showed a high objective response rate (ORR) of 72.4% and disease control rate (DCR) of 100%, reflecting robust clinical efficacy. Despite a net loss of ¥238.59 million in H1 2024, the company's focus on groundbreaking therapies positions it for potential long-term growth within the sector.

- Navigate through the intricacies of Akeso with our comprehensive health report here.

Learn about Akeso's historical performance.

Key Takeaways

- Discover the full array of 45 SEHK High Growth Tech and AI Stocks right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kuaishou Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10