Seatrium And 2 Other SGX Stocks That Could Be Trading Below Intrinsic Value

The Singapore market has been experiencing a period of cautious optimism, with investors closely monitoring economic indicators and corporate earnings reports. As the market navigates these conditions, identifying undervalued stocks becomes crucial for those looking to capitalize on potential growth opportunities. In this article, we will explore Seatrium and two other SGX stocks that could be trading below their intrinsic value, offering insights into why they might be worth a closer look in the current landscape.

Top 5 Undervalued Stocks Based On Cash Flows In Singapore

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Singapore Technologies Engineering (SGX:S63) | SGD4.67 | SGD7.36 | 36.5% |

| Digital Core REIT (SGX:DCRU) | US$0.57 | US$0.81 | 29.8% |

| Nanofilm Technologies International (SGX:MZH) | SGD0.81 | SGD1.43 | 43.3% |

| Seatrium (SGX:5E2) | SGD1.65 | SGD2.93 | 43.7% |

| Frasers Logistics & Commercial Trust (SGX:BUOU) | SGD1.17 | SGD1.59 | 26.4% |

Click here to see the full list of 5 stocks from our Undervalued SGX Stocks Based On Cash Flows screener.

Let's take a closer look at a couple of our picks from the screened companies.

Seatrium (SGX:5E2)

Overview: Seatrium Limited, with a market cap of SGD5.61 billion, offers engineering solutions to the offshore, marine, and energy industries.

Operations: Seatrium Limited generates revenue primarily from Rigs & Floaters, Repairs & Upgrades, Offshore Platforms, and Specialised Shipbuilding (SGD8.39 billion), with additional income from Ship Chartering (SGD24.71 million).

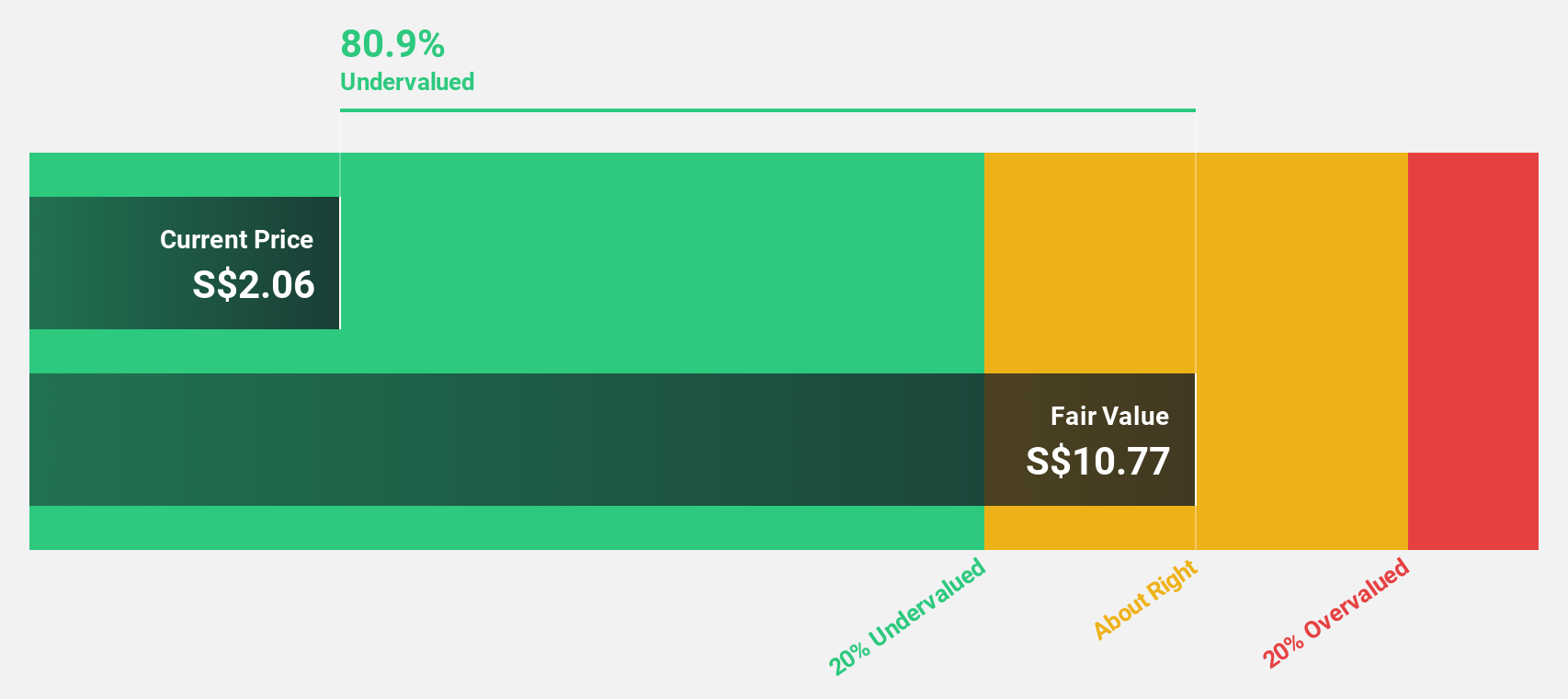

Estimated Discount To Fair Value: 43.7%

Seatrium Limited appears significantly undervalued, trading at 43.7% below its estimated fair value of S$2.93 per share, with a current price of S$1.65. The company recently reported a net income of S$35.97 million for H1 2024, a substantial turnaround from a loss the previous year, driven by increased sales and successful project executions like the early delivery of the Vali rig to Borr Drilling. Analysts expect continued profitability growth over the next three years.

- Insights from our recent growth report point to a promising forecast for Seatrium's business outlook.

- Take a closer look at Seatrium's balance sheet health here in our report.

Frasers Logistics & Commercial Trust (SGX:BUOU)

Overview: Frasers Logistics & Commercial Trust (SGX:BUOU) is a Singapore-listed real estate investment trust with a market cap of approximately S$4.40 billion, managing a portfolio of 107 industrial and commercial properties valued at around S$6.40 billion across Australia, Germany, Singapore, the United Kingdom and the Netherlands.

Operations: FLCT generates revenue primarily from its portfolio of 107 industrial and commercial properties valued at approximately S$6.4 billion, diversified across Australia, Germany, Singapore, the United Kingdom and the Netherlands.

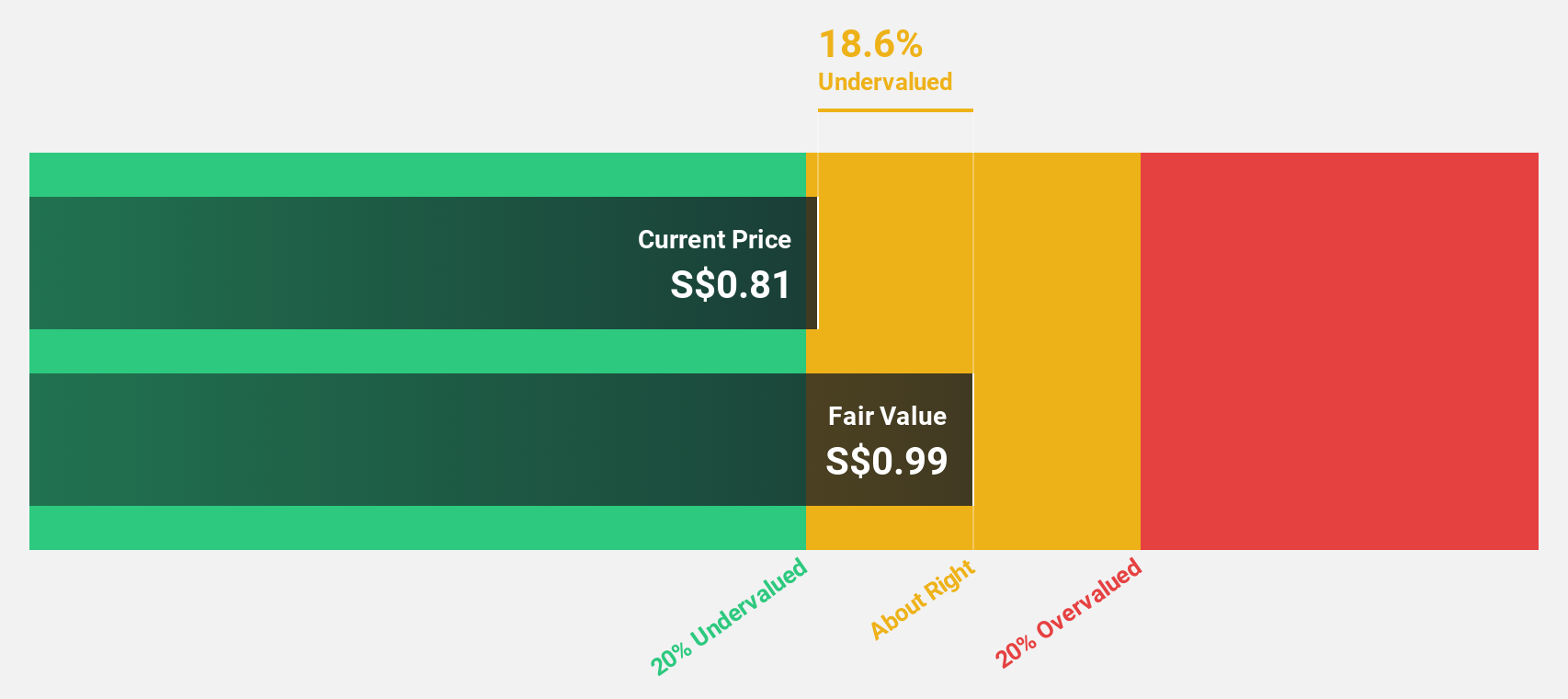

Estimated Discount To Fair Value: 26.4%

Frasers Logistics & Commercial Trust is trading at S$1.17, significantly below its estimated fair value of S$1.59, indicating it may be undervalued based on cash flows. The trust's revenue is forecast to grow 6.3% annually, outpacing the broader Singapore market's growth rate of 3.6%. Earnings are expected to rise by 39.43% per year and become profitable within three years, despite a low forecasted return on equity of 5.8%. However, debt coverage by operating cash flow remains a concern.

- Our expertly prepared growth report on Frasers Logistics & Commercial Trust implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of Frasers Logistics & Commercial Trust.

Singapore Technologies Engineering (SGX:S63)

Overview: Singapore Technologies Engineering Ltd operates as a global technology, defence, and engineering company with a market cap of SGD14.56 billion.

Operations: The company generates revenue from three main segments: Commercial Aerospace (SGD4.34 billion), Urban Solutions & Satcom (SGD2.01 billion), and Defence & Public Security (SGD4.54 billion).

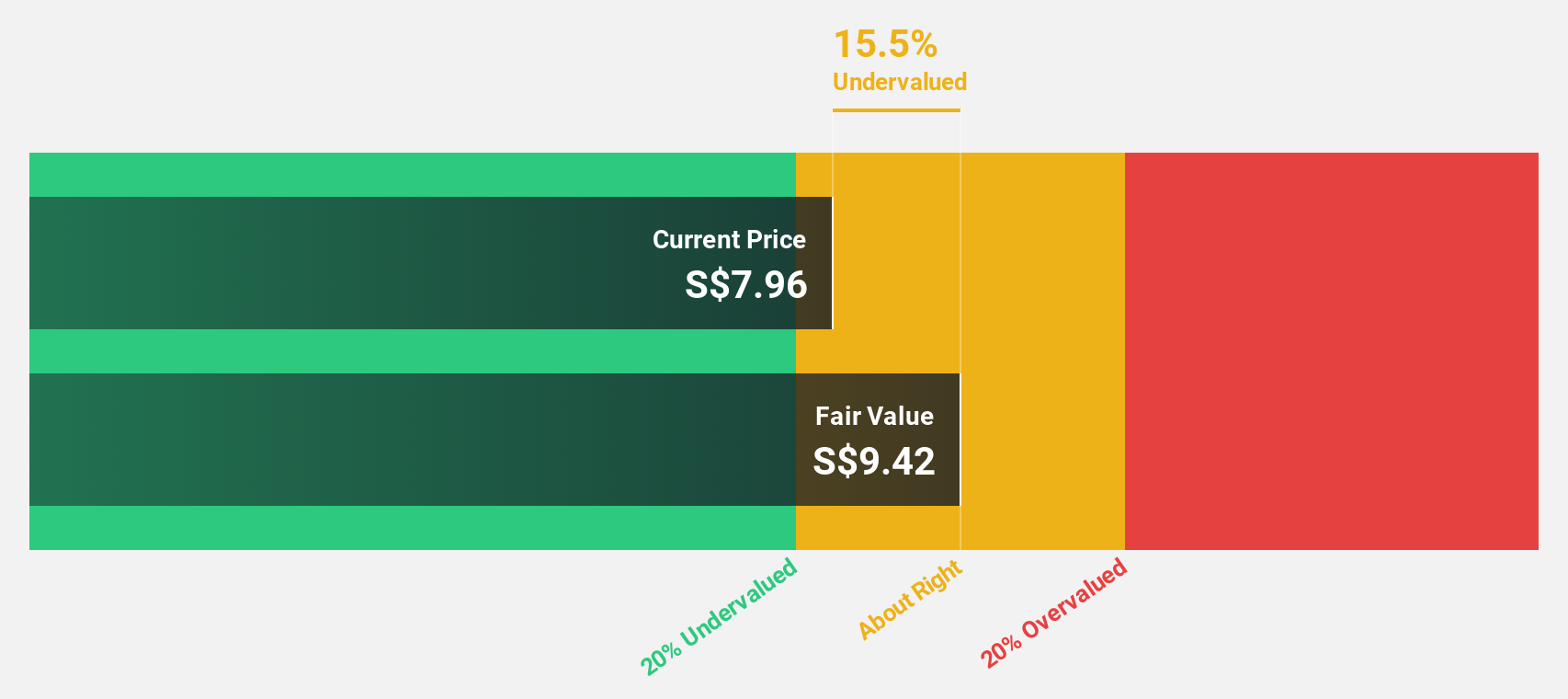

Estimated Discount To Fair Value: 36.5%

Singapore Technologies Engineering is trading at S$4.67, considerably below its estimated fair value of S$7.36, suggesting it is undervalued based on cash flows. The company’s earnings are projected to grow 11.15% annually, surpassing the Singapore market's average growth rate of 9.9%. Despite this positive outlook, debt coverage by operating cash flow remains a concern. Recent strategic alliances in quantum-secure communications could enhance its market position and revenue streams in critical sectors like government and financial services institutions.

- In light of our recent growth report, it seems possible that Singapore Technologies Engineering's financial performance will exceed current levels.

- Navigate through the intricacies of Singapore Technologies Engineering with our comprehensive financial health report here.

Turning Ideas Into Actions

- Access the full spectrum of 5 Undervalued SGX Stocks Based On Cash Flows by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10