Palantir: Hope Is Not A Strategy

Summary

Palantir Technologies Inc. is extremely overvalued, with valuation multiples like P/E ratio of 617 and P/S ratio above 100, making it a 'Strong Sell.'

Despite impressive revenue and earnings growth, Palantir's stock price is unjustifiable on a fundamental basis, driven by irrational exuberance.

The stock's high valuation can't be sustained by its growth rates, in my opinion, and investors risk potentially significant losses.

Sentiment is driving Palantir's stock price, but fundamentals will eventually correct the overvaluation, likely resulting in a steep decline.

In the last half year, I wrote two very bearish articles about Palantir Technologies Inc. (NASDAQ:PLTR) and in both, I rated the stock as a “Sell”. One article was published in September 2024, the other was published in December 2024. Looking back at these two articles, it seems like I made huge investing mistakes. In both articles, I argued that Palantir is way too expensive, but the stock just continues to rally. Since my last article, the stock has increased 70%, and since my article in September, the stock has increased by 200% in only 5 months.

Ratings for Palantir (Seeking Alpha)

At least when looking at other analysts, I am not the only one who is bearish (or at least neutral). In the last 30 days, 18 out of 46 Seeking Alpha analysts rated the stock as a “Sell” or “Strong Sell”. I hope I am not killing the suspense, but I will now also change my rating for “Sell” to “Strong Sell” because Palantir’s stock price is far beyond reasonable.

In the following article, I will explain once again why I believe Palantir stopped being an investment we can justify on a fundamental basis long ago – despite the business growing at a high pace and growth even accelerating in the last few quarters.

Valuation Multiples

We once again start by looking at valuation multiples. Although not the perfect metric to determine if a stock is over- or undervalued, it is a starting point. And the problem of Palantir can be summed up in the following way: The stock price is increasing at a fast pace, and this would be acceptable if growth rates are justifying that. This would result in valuation multiples remaining at the same level. If a great business was constantly trading for 50 times free cash flow because free cash flow is growing with a pace of 50% annually it is acceptable if the stock price is also increasing 50% annually.

But in case of Palantir, the situation is different. Over the last few months, the valuation multiples exploded, and we can look at three different valuation multiples – and all three show clear signs of irrational exuberance in my view.

Data by YCharts

When looking at the P/E ratio, Palantir is trading for 617 times earnings. When looking at the P/FCF ratio, the stock is trading only for 252 times free cash flow, but both metrics are beyond being reasonable. Now we can argue that earnings per share and free cash flow can fluctuate heavily and as we are always using the trailing twelve months numbers to calculate these valuation multiples, we are dependent on the reported numbers in the last twelve months. This is the reason forward ratios are often used, but even the forward P/E ratio is currently 213.

Data by YCharts

Aside from P/FCF and P/E ratio, we can look at the price-sales ratio, which is above 100. And to mention the counterargument right away: the price-sales ratio has its limitations to reflect constantly improving margins. But that discussion is moot because 100 times sales (and we are not talking about a small company anymore, Palantir is already generating close to $3 billion in sales) is beyond reasonable. Maybe you are familiar with the quote of Scott McNealy, the CEO of Sun Microsystems during the Dotcom bubble, who gave an interview a few years later:

At 10 times revenues, to give you a 10-year payback, I have to pay you 100% of revenues for 10 straight years in dividends. That assumes I can get that by my shareholders. That assumes I have zero cost of goods sold, which is very hard for a computer company. That assumes zero expenses, which is really hard with 39,000 employees. That assumes I pay no taxes, which is very hard. And that assumes you pay no taxes on your dividends, which is kind of illegal. And that assumes with zero R&D for the next 10 years, I can maintain the current revenue run rate. Now, having done that, would any of you like to buy my stock at $64? Do you realize how ridiculous those basic assumptions are? You don’t need any transparency. You don’t need any footnotes. What were you thinking?

Maybe we will read a similar statement about Palantir in a few years from now. Additionally, we always have to remember that McNealy was talking about a stock trading for 10 times sales, and we are talking about a stock trading for 100 times sales.

Sparkline Capital

When looking back at some of the peak valuation multiples during the Dotcom bubble, we can conclude that 10 times sales was not as extreme as there were several companies trading for P/S ratios way above 100. But when looking at the valuation multiples today and focus on the S&P 500, there are no stocks trading for a P/S ratio above 100 and while there are 45 companies trading for a price-sales ratio above 10, no stock is coming close to Palantir. NVIDIA Corporation (NVDA) and CrowdStrike Holdings (CRWD) are trading for 30 times sales, and the Texas Pacific Land Corporation (TPL) is runner-up with a price-sales ratio of 45.

Quarterly Results

The counterargument for high valuation multiples is usually explosive growth. In case of Palantir, I don’t want to deny that the business is growing with a high pace and growth is accelerating. When looking at the full-year results, revenue increased from $2,225 million in fiscal 2023 to $2,866 million in fiscal 2024 – resulting in 28.8% year-over-year growth. Income from operations increased even 159% year-over-year from $120.0 million in fiscal 2023 to $310.4 million in fiscal 2024. And diluted earnings per share increased from $0.09 in fiscal 2023 to $0.19 in fiscal 2024 – resulting in 111% bottom-line growth. Finally, adjusted free cash flow increased from $730.5 million in fiscal 2023 to $1,249 million in fiscal 2024.

Palantir Q4/24 Earnings Release

We can also look at fourth quarter results. Revenue increased from $608.4 million in Q4/23 to $827.5 million in Q4/24. Income from operations, however, declined from $65.8 million in the same quarter last year to $11.0 million in Q4/24. Diluted earnings per share declined from $0.04 in Q4/23 to $0.04 in Q4/24. And adjusted free cash flow in the fourth quarter increased 69.8% year-over-year from $304.8 million in Q4/23 to $517.4 million in Q4/24. The adjusted free cash flow margin improved from 50% in Q4/23 to 63% in Q4/24. The declining bottom line and declining operating income in the fourth quarter is mostly the result of much higher expenses for sales and marketing ($288 million compared to $197 million) and higher expenses for research and development ($109 million vs. $171.5 million this quarter).

Accelerating Growth

Aside from impressive results and high growth in fiscal 2024, we can also point out that growth is accelerating in the recent past. When looking at quarterly revenue growth in the last few years, Palantir has been growing with a higher pace at one point but since mid-2023, revenue growth accelerated from 12.8% YoY growth to 36% YoY growth right now.

Data by YCharts

However, growth will obviously not accelerate in 2025 anymore. For the full year, management is expecting revenue to be between $3,741 million and $3,757 million resulting in about 31.0% to 31.5% year-over-year growth. Adjusted free cash flow is projected to be between $1.5 billion and $1.7 billion resulting in 20% to 36% YoY growth.

Palantir Q4/24 Presentation

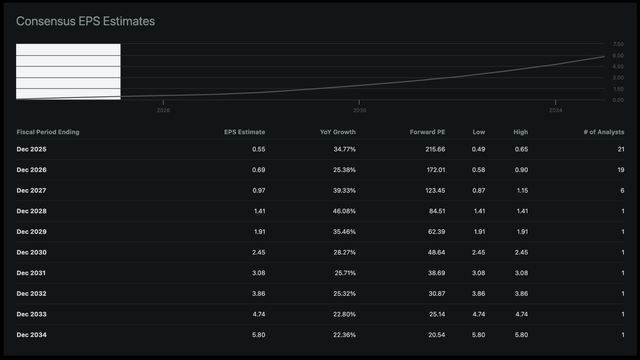

Of course, I don’t want to badmouth Palantir’s results and guidance and for the next ten years until fiscal 2034, analysts are expecting growth rates of 30% annually, which are extremely high growth rates.

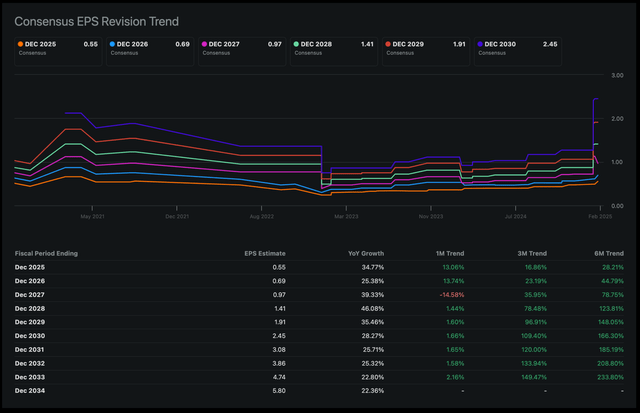

And aside from expecting high growth rates, analysts are getting more optimistic about revenue and earnings per share in the years to come. Especially in the recent past, analysts got more optimistic about earnings per share in the next few years.

Intrinsic Value Calculation

The problem with these growth rates is quite simple: 36% revenue growth in Q4/24 and a CAGR of 30% for earnings per share in the next ten years are very impressive. But it is nowhere near enough to make Palantir fairly valued right now.

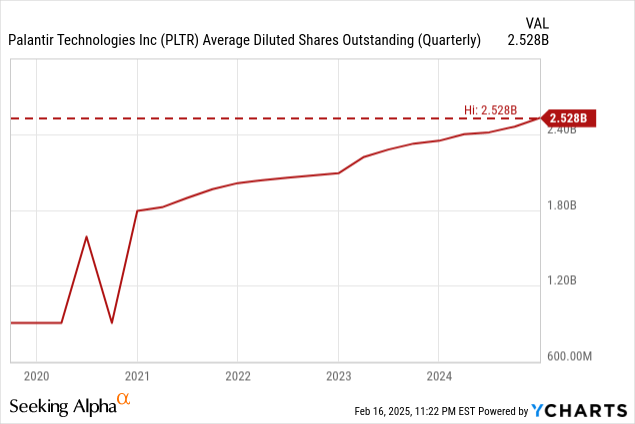

In the following sections, we use a discount cash flow calculation to determine an intrinsic value. And for such a calculation we usually must make several assumptions. As a basis for our calculation, we take the midpoint of the guidance for fiscal 2025 ($1.6 billion in free cash flow). Additionally, we calculate with 2,528 million shares outstanding and as always, we are calculating with a 10% discount rate (as this is the annual return we like to achieve at least).

When calculating with these assumptions, Palantir must grow 36% annually for the next ten years, followed by 6% growth until perpetuity. And we can look at these numbers a little closer and point out where the challenges might lie. For starters, 6% growth until perpetuity is considered too high and unreasonable by the CFI, which is recommending a terminal growth rate not higher than 4%. But let’s be optimistic and assume Palantir can grow at a high pace for a long time.

A second problem is one I mentioned several times in the past, but it needs to be addressed again. Palantir is continuing to dilute its shares outstanding and in fiscal 2024 the number of diluted shares increased by 7.2% once again and to offset such a dilution, Palantir must grow its bottom line 43% annually for the next ten years.

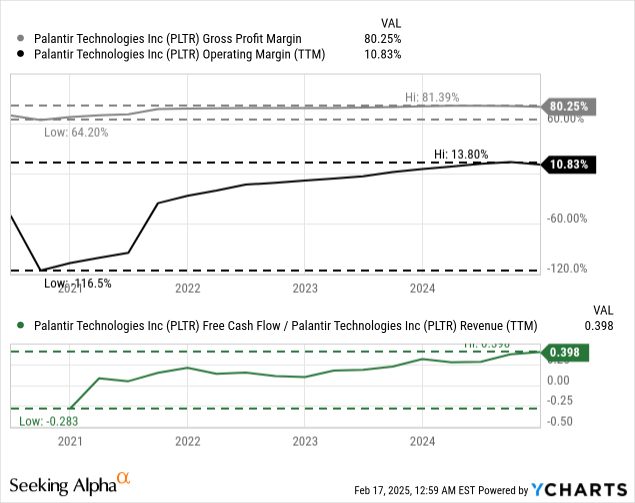

Bottom line growth can usually stem from many different sources – share buybacks, margin improvement or top line growth. Share buybacks are nothing we should talk about right now. A second way to grow bottom line is by improving margins. And while we can certainly argue that operating margin has room to improve, gross margin is already high. But what is most important is the free cash flow margin, which is already 40%. And while we can always be optimistic and assume higher margins, we should be cautious about how optimistic we are. Palantir’s free cash flow guidance for fiscal 2025 is already assuming a free cash flow margin of 45% (on the upper end).

In my opinion, we should not bet on margin improvements to contribute to bottom line growth. We should rather be a little cautious if Palantir can maintain a 45% free cash flow margin over the long run. Such a margin is certainly possible, but we should not take it for granted.

This leaves mostly the top line, which must contribute to growth. And despite reasons to be optimistic, I don’t know if we should really expect growth rates between 40% and 45% for the next 10 years. Once again, it is possible, but it is not a bet I am willing to take, and I believe the risk of losing a lot of money in the next few years is high.

Sentiment, Psychology, and Correction

Before we come to an end and conclude once again that Palantir is extremely overvalued, we must talk about something else. How is it possible that people have made a lot of money when Palantir is extremely overvalued? And: Why is Palantir continuing to rise and rise when it is so extremely overvalued?

For example, if someone had bought close to the low of $6 in late 2022, the position gained 1,850% in a little more than two years. And even those that bought half a year ago – at a point where I already argue that Palantir is extremely overvalued – the profits were still impressive. And bulls will probably argue that I (and many others) just have to accept that the bearish position was wrong because the stock price, and bulls making money is the best proof of the bulls being right all along.

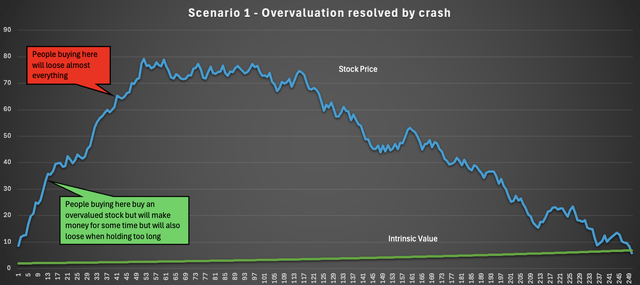

The answer is very simple: Sentiment is driving the stock market and therefore stock prices, which are not justified in any way from a fundamental point of view, are possible for a long time – sometimes even several years or longer. But at some point, these “inconsistencies” will always (!) be resolved. The “problem” is that extreme overvaluation can be solved in several ways.

One way and the most common ways is a crash of the stock price. Extreme overvaluation of a stock or index is usually followed by a very steep decline. In this scenario, those investors buying at a high price or close to the top will lose a lot of money. These are crashes we remember – like the Dotcom bubble, the Great Financial Crisis or many stocks belonging to the Nifty Fifty.

Exemplary chart data created with Python script (Author's work)

But there is a second way. Extreme overvaluation can also be resolved by a stock stagnating for several years (or maybe even decades). In this scenario, the stock price is remaining at the same level, but with fundamentals continuing to improve – revenue and free cash flow increase – the valuation multiples decline until the stock is reasonably valued and can continue its increase.

Exemplary chart data created with Python script (Author's work)

And there is a third way, which is the most dangerous, as it tells investors they were right all along buying Palantir for 100 times sales. For companies growing at a high pace (and Palantir is falling into that category) it is possible that the stock price is growing at a slower pace than fundamentals. Palantir can, for example, grow its free cash flow 25% annually for the next ten years while the stock price is growing only 5% or 8% annually. This will also resolve the high valuation over time. Similar to a beautiful deleveraging Ray Dalio is describing, this would be the scenario of a “beautiful bubble burst”. In this scenario, investors will not make a lot of money, but they also won’t have the feeling of having invested in an extremely overvalued stock.

Predicting which path a stock will go seems almost impossible, and therefore buying Palantir at this point is extremely risky (to avoid stronger terms here). Of course, there are scenarios where investors might not lose money as the stock continues to increase. However – and this is important – the stock is still not a good investment, as the stock climbs very slowly. In the end, fundamentals matter.

Conclusion

Even with a theoretical scenario in which investors in Palantir could make a little money over the next decade, the stock is extremely overvalued and in the wide range of potential investments in the United States it is very close to the bottom with zero or negative potential returns. The most likely scenario is Palantir declining steeply in the next few years as it is becoming more difficult to justify the current stock price. And therefore, the only rating making sense right now is a “Strong Sell” rating.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10